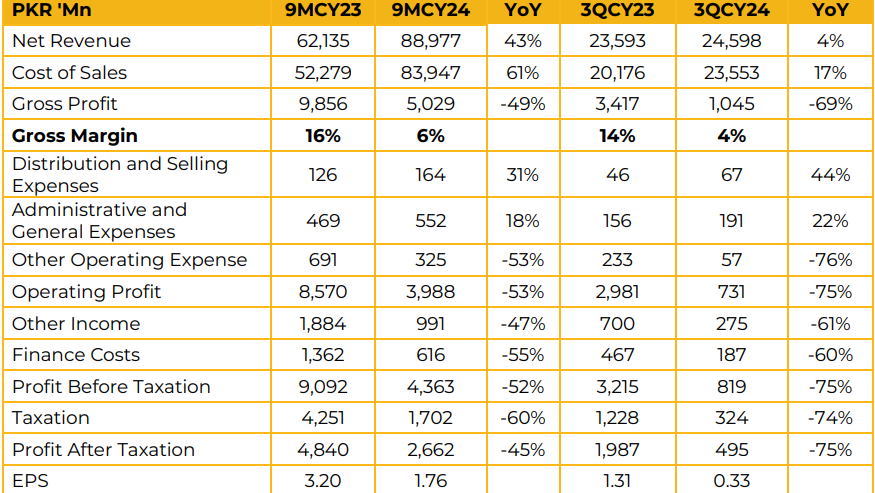

Lotte Chemical Pakistan Limited (LOTCHEM) reported a net profit of PKR 2.66 billion (EPS: PKR 1.76) in 9MCY24. This represents a 45% decline from a net profit of PKR 4.84 billion (EPS: PKR 3.20) in the same period last year (SPLY).

Revenue for 9MCY24 increased by 43% year-on-year to PKR 88.98 billion, compared to PKR 62.14 billion in 9MCY23. The trading of Acetic Acid contributed gross profit of PKR 358 million during 9MCY24. The price of Acetic Acid ranged between $450 and $500 per ton during the period.

LOTCHEM is the sole producer of purified terephthalic acid (PTA) in Pakistan, with an annual production capacity of 500 KT. Approximately 40% of the company’s sales are made to Novatex Limited.

The company’s energy mix comprises 24% RLNG and 76% gas. Gas supply was uninterrupted from the government during the period. The company’s gas requirement is 6–7 mmbtu.

Management plans to rely on K-Electric as a backup electricity source if the government suspends gas supply to captive power plants. The company paid advance taxes based on the assessed taxto-turnover ratio and expects to receive a refund after finalizing this year’s tax liability.

Management reported low production levels, citing challenges stemming from higher interest rates and elevated energy prices, which have impacted their downstream customers. The demand for PTA in the domestic market is estimated at 700 KT. The duty structure for PTA and PX remained unchanged in the FY25 financial budget.

Going forward, management expects demand to recover following the finalization of an energy package for the industry. The company is actively engaging with the government and other stakeholders. Management anticipates sustained PTA margins in the coming year.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose