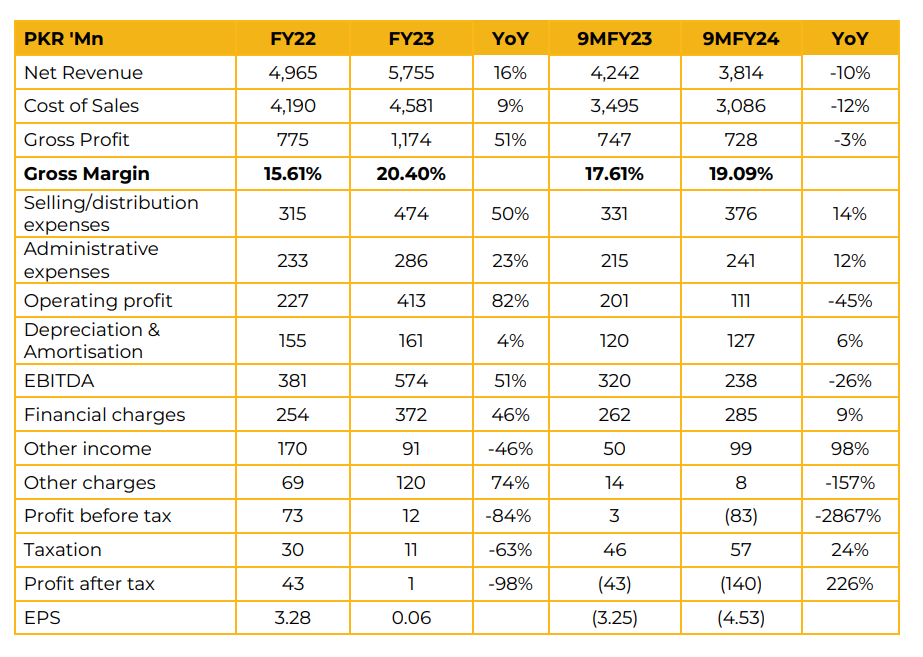

In 9MCY24, KSB Pumps Company Limited (KSBP) reported a net loss of PKR 139.84 million (LPS: PKR 4.53), compared to a net loss of PKR 42.93 million (LPS: PKR 3.25) in the same period last year (SPLY). Order intake increased by 20.5% YoY to 5,245 orders in 3QCY24, compared to 4,359 orders in the SPLY. However, sales declined by 10% YoY to PKR 3.81 billion from PKR 4.24 billion, primarily due to order deliveries expected in 4QCY24 and 1QCY25. Orders in hand grew 32% YoY to 3,724 orders in 3QCY24, compared to 2,820 orders in the SPLY. Government contracts in Lahore have increased due to rising public sector spending on water management.

Financial costs rose by 8.7% to PKR 285 million in 3QCY24. The company paid off PKR 1.7 billion in legacy debt in 4QCY24. Inventory days increased to 3-6 months from the previous 3 months due to supply chain disruptions. The company is currently operating at 4,000 tons per annum in its Foundry segment, against a total capacity of 10,000 tons per annum, with exports contributing 10%. KSBP aims to increase production to 8,000-10,000 tons per annum by 2026. The company expects improved financial performance from 2025 onward, supported by surplus capacity and an improving economy. Exports were estimated at PKR 1.2-1.5 billion in CY24.

The casting business for the automobile sector generated PKR 500-700 million, while exports to group companies contributed PKR 150-200 million. Despite lower contribution margins, higher volumes support profitability. The water segment accounted for 30-35% of sales in 2024, varying with government spending, while the industrial sector contributed 30-35%. High-rise buildings made up the remaining 10-12% of revenue. In mining, the Rekodiq project remains in the design phase, with service-related contracts expected in 2HCY25.

The company anticipates higher local and export sales. KSBP continues to serve juice circulation and bagasse-based power plants in the sugar sector In 9MCY24, KSB Pumps Company Limited (KSBP) reported a net loss of PKR 139.84 million (LPS: PKR 4.53), compared to a net loss of PKR 42.93 million (LPS: PKR 3.25) in the same period last year (SPLY). Order intake increased by 20.5% YoY to 5,245 orders in 3QCY24, compared to 4,359 orders in the SPLY. However, sales declined by 10% YoY to PKR 3.81 billion from PKR 4.24 billion, primarily due to order deliveries expected in 4QCY24 and 1QCY25. Orders in hand grew 32% YoY to 3,724 orders in 3QCY24, compared to 2,820 orders in the SPLY. Government contracts in Lahore have increased due to rising public sector spending on water management. Financial costs rose by 8.7% to PKR 285 million in 3QCY24. The company paid off PKR 1.7 billion in legacy debt in 4QCY24. Inventory days increased to 3-6 months from the previous 3 months due to supply chain disruptions.

The company is currently operating at 4,000 tons per annum in its Foundry segment, against a total capacity of 10,000 tons per annum, with exports contributing 10%. KSBP aims to increase production to 8,000-10,000 tons per annum by 2026. The company expects improved financial performance from 2025 onward, supported by surplus capacity and an improving economy. Exports were estimated at PKR 1.2-1.5 billion in CY24. The casting business for the automobile sector generated PKR 500-700 million, while exports to group companies contributed PKR 150-200 million. Despite lower contribution margins, higher volumes support profitability.

The water segment accounted for 30-35% of sales in 2024, varying with government spending, while the industrial sector contributed 30-35%. High-rise buildings made up the remaining 10-12% of revenue. In mining, the Rekodiq project remains in the design phase, with service-related contracts expected in 2HCY25. The company anticipates higher local and export sales. KSBP continues to serve juice circulation and bagasse-based power plants in the sugar sector

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.