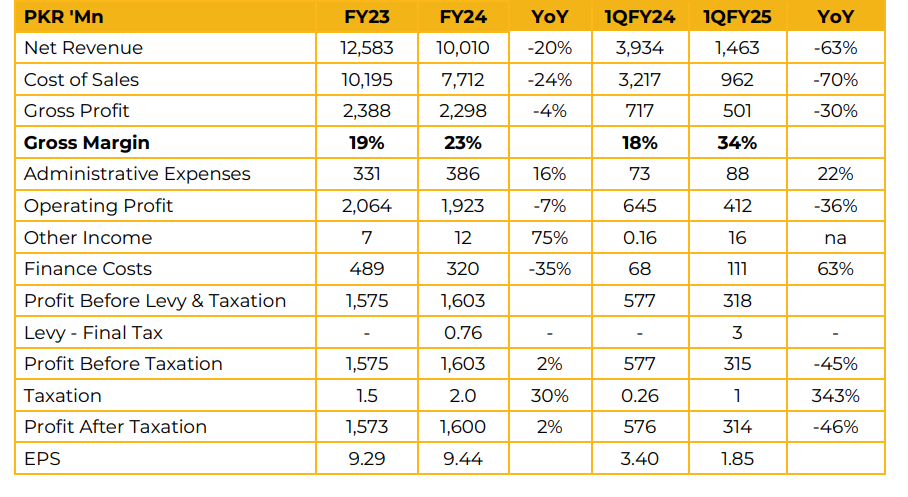

In FY24, Kohinoor Energy Limited reported a net profit of PKR 1.60 billion (EPS: PKR 9.44), reflecting a 2% increase from the previous year’s net profit of PKR 1.57 billion (EPS: PKR 9.29). However, the KOHE reported a profit of PKR 313.73 million (EPS: PKR 1.85) in 1QY25, compared to PKR 576.50 million (EPS: PKR 3.40) during the SPLY. KOHE has agreed to amend its PPA and Implementation Agreement, adopting a “Hybrid Take-and-Pay” tariff model effective November 1, 2024.

Management reported that the frozen portion of the escalable component will be paid under a hybrid model, with 35% on a take-or-pay basis and 65% on a take-and-pay basis. The indexable portion of the escalable component (unfrozen part) has been reduced by 30% and paid on takeor-pay basis and will now be indexed annually at 5% or NCPI, whichever is lower. The settlement of the outstanding principal will be completed within 90 days without late payment charges.

KKOHE had agreed to write off PKR 195 million against an outstanding amount of PKR 2.7 billion as on October 31, 2024. Liquidated damages will not be provisioned as they were part of an unresolved dispute. To settle the matter, the plant will remain operational for an additional 161 days after the PPA’s original expiry, now extended to December 2027.

During this period, KEL will receive variable costs with no capacity payments. KEL explores options after expiry of PPA agreement after 2027 such as bilateral contracts under CTBCM, direct contracts with Discos and thirdly is the option to have contract with Sunderland industrial estate firms. KEL’s PPA-based solar business has signed an MOU with Sundar Industrial Estate to offer 1MW solar power plants to their member companies on a rental payment basis, aiming to secure business opportunities through its subsidiary.

Going forward, these adjustments will lower fixed costs by Rs. 250 million through HR rightsizing while reducing capacity payment revenue. KEL projects annual cash generation of Rs. 1 billion, down from Rs. 2 billion, but anticipates no negative impact on its bottom line.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose