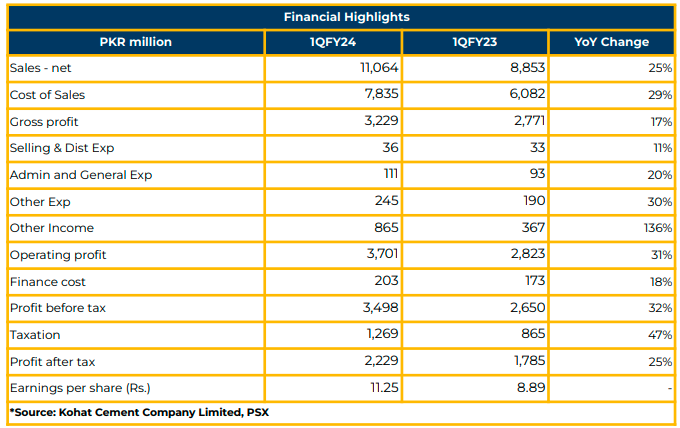

In 1QFY24, Kohat Cement Company Limited posted a net income of PKR 2.23 billion (EPS: PKR 11.25), marking a 25% YoY increase, contrasting with PKR 1.79 billion (EPS: PKR 8.89) in the same period last year. The company’s revenue surged by 25% YoY to PKR 11.06 billion in 1QFY24, compared to PKR 8.85 billion in the SPLY.

Selling and distribution expenses increased by 11% YoY to PKR 36.10 million from PKR 32.60 million in the SPLY. Similarly, administration expenses rose by 20% YoY to PKR 111.13 million compared to PKR 92.87 million in SPLY. Simultaneously, the gross profit increased by 17% YoY to PKR 3.23 billion, up from PKR 2.78 billion in the SPLY. Operating profit experienced robust growth of 31% YoY, reaching PKR 3.70 billion in 1QFY24 compared to PKR 2.82 million in SPLY.

The finance cost of the company increased by 18% YoY to PKR 203.05 million in 1QFY24 compared to PKR 172.64 million in SPLY. Additionally, the company registered a 136% YoY increase in other income, totaling PKR 864.51 million in 1QFY24 compared to PKR 366.97 million in SPLY due to income from investments.

Local dispatches of the company decreased by 16% YoY to 2.97 MMT, while export dispatches increased by 312% YoY to 31.66 KT in FY23. In 1QFY24, local dispatches increased by 11% QoQ to 745 KT, and export dispatches decreased by 23% QoQ to 16.23 KT.

The capacity utilization remained at 58.2% in FY23 compared to 69% in FY22. Likewise, the capacity utilization was reported at 59% 1QFY24.

The debt to equity ratio, interest coverage ratio, and debt service coverage ratio were reported at 9:91, 15.14, and 7.25, respectively, in FY23. ROE and ROCE were reported at 17.8% and 34.4%, respectively, during the same period.

After the first buyback, the company is considering a second buyback, and negotiations are underway with consultants for this.

Due to the higher cost of the coal power plant, the company is shifting its focus towards solar power plants. Moreover, Kohat Cement relaunched white cement after changing the recipes one month ago. MLCF enjoys the highest market share in white cement, as per management.

The power mix of Kohat Cement consisted of grid (69%), and Captive Generation (31%) in FY23. However, the grid contribution was reduced to 66% in 1QFY24. The average grid rate was reported at PKR 32.12 per Kwh in FY23, while it was reported at PKR 37.74/Kwh in 1QFY24. The company uses 30% local coal, and 70% is a mixture of Afghan and imported coal. The cost of Afghan coal was estimated at PKR 53,000 per ton.

BMR on Line III is expected to reduce coal consumption by 10%-12%, with testing scheduled for next month. Inland freight cost was reported at PKR 9,000. Kohat Cement has acquired land for the Greenfield Cement project and is working on the development of this land. The estimated cost of this project is PKR 40 billion. However, the opening of LCs is the main hurdle in the import of necessary machinery.

The retention price was reported at PKR 15,000 per ton in 2QFY24 against 14500 per ton in 1QFY24.

Going forward, the management anticipates robust cement demand, increasing by 5-6% in FY24. Moreover, the management shared that 2MT will be added by FCCL in addition to the 11MT already added in FY23. Regarding power consumption, Kohat Cement is actively working on a 15 MW solar power plant, expected to meet 15% of the company’s energy requirements.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.