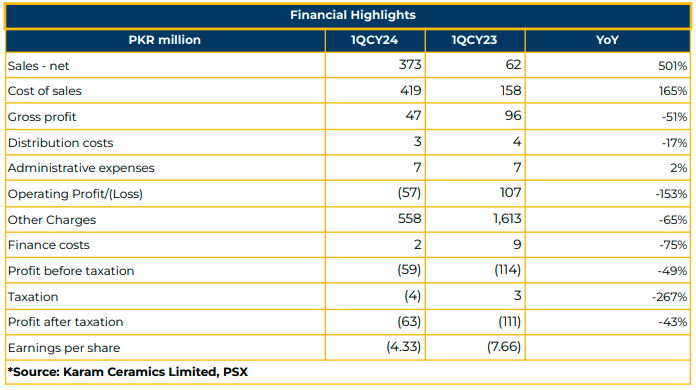

In 1QFY24, Karam Ceramics Limited (KCL) reported a net loss of PKR 62.99 million (LPS: PKR 4.33), marking a significant decrease from the net loss of PKR 111.48 million (LPS: PKR 7.66) in the same period last year (SPLY).

The company’s topline experienced a notable year-on-year surge to PKR 372.66 million in 1QFY24, the highest revenue after the acquisition, compared to PKR 62.02 million in the corresponding period of the previous year. Gross loss also witnessed a decrease, reaching PKR 46.79 million in 1QFY24 from the gross loss of PKR 96.25 million in SPLY.

Cost of sales amounted to PKR 419.45 million in 1QFY24, reflecting a notable increase of 165% YoY from PKR 158.27 million in the corresponding period last year. Other income saw a significant decline of 65% YoY to PKR 557.69 million, compared to PKR 1.61 billion in SPLY.

Distribution expenses declined by 17% YoY to PKR 3.03 million, whereas administrative expenses increased by 2% YoY to PKR 7.12 million. Finance costs witnessed a 75% YoY decrease to PKR 2.20 million in 1QFY24. The Loss Before Tax for 1QFY24 decreased to PKR 58.59 million, compared to a loss of PKR 114.12 million in SPLY.

In FY23, KCL achieved a sales revenue of PKR 977 million compared to PKR 818 million in SPLY. The Company successfully achieved higher revenue despite plant closure for five months after acquiring the Company.

Karam Ceramics Limited with the brand name NOVA is equipped with the latest state-of-the-art technology and machinery to manufacture tiles. After acquiring the Company, the management rebranded the products, imported necessary machinery and plant, and improved the quality of products.

KCL launched 10 by 20, 16 by 16, and 12 by 12 tiles, whereas 12 by 24, 60 by 60, and 60 by 120 tiles are under progress and about to launch this year. For all these upgrades and launches, KCL generated in-house capital with director’s loans of PKR 700 million during FY23.

Management highlighted that the price of raw material and freight costs have increased. Additionally, KCL aims to target the Sindh market completely before penetrating Punjab and other regions in Pakistan. The

Company is using gas and coal in production. The higher gas rates significantly increased the cost of inputs.

Going forward, the management aims to double the revenue by next year with increased capacity utilization and price increases to improve margins. Moreover, KCL is committed to improving the quality of the products.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.