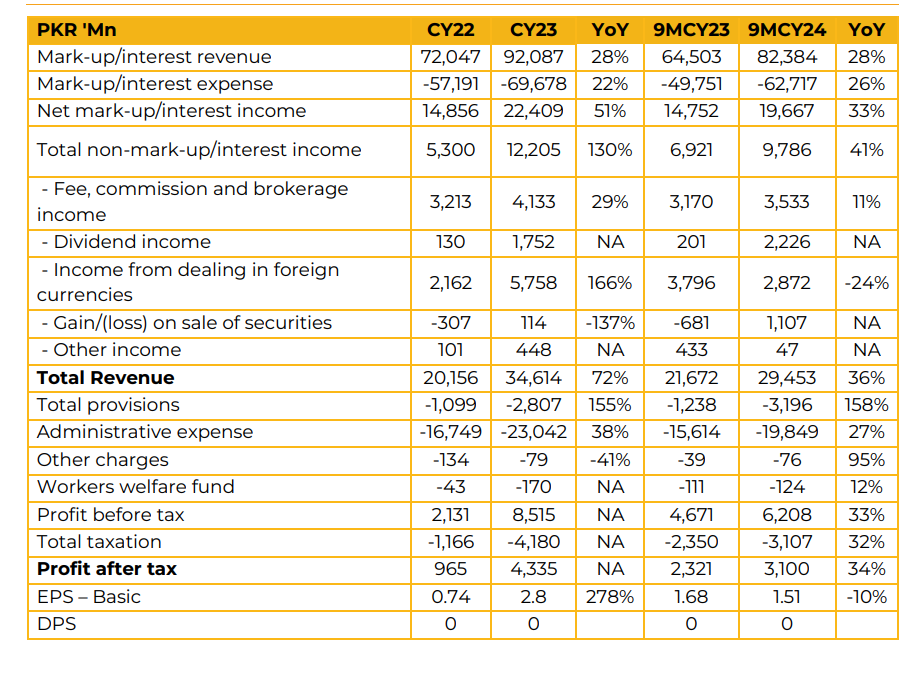

The company’s earnings per share increased by 278% to PKR 2.8 in CY23, compared to PKR 0.74 in CY22. In 9MCY23, the company’s earnings per share decreased by 10% to PKR 1.51 compared to PKR 1.68 9MCY22. Net Interest Income (NII) for the nine months ended stood at PKR 19,667 million, reflecting a 33% increase.

The management highlighted that new advances extended are having short-term maturities, additionally they offered competitive lending rates, unlike other banks that have extended loans at significantly lower rates than KIBOR. Bank’s lending is close to KIBOR, which was a short-term strategy linked to ADR.

The primary reason for their low price-to-book ratio is that they have no dividend history so far. Regarding asset quality, they highlighted that they have made significant provisions over the past two years, they had booked provisions for Amreli and Agha Steel.

The management expect their coverage ratio to reach close to 70% by December and aiming 80% for the following year. The bank is in the process of acquiring software and modules specifically for Islamic banking.

The abolishment of the ADR requirement is beneficial for the bank in the long run, as they don’t have to adjust their books to achieve higher ADR.

The bank cannot use group tax benefits since these apply only to entities with 100% ownership of a subsidiary, whereas they hold a 75% stake in BIPL. Regarding income from BIPL, they added that it falls under one basket and is taxed at the same rate as corporate tax. Management mentioned they postponed dividend payments as they are aggressively transitioning toward Islamic banking.

They shared that they have invested 2.3 billion in the Zindigi app over nine months, they anticipate these revenues to reach up to 7 billion by next year.

Currently, their current account deposits stand at 30%, with CASA at 71%. Looking ahead, their focus is increasingly on the digital front. In the Zindigi app (employee banking franchise) they have secured 10 billion in deposits. Under its Bank Islami division, the bank opened 100 branches in 2024 and plans to expand further in the current year.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.