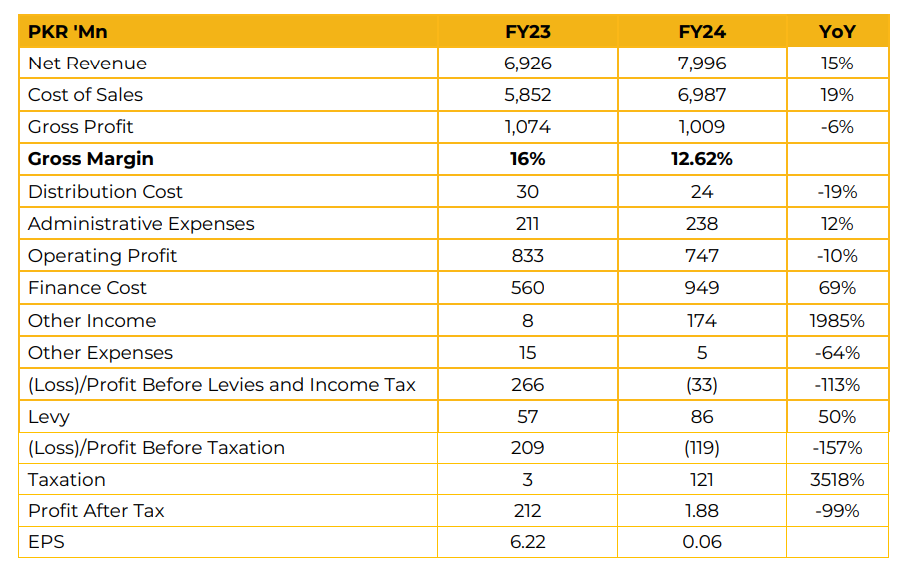

In FY24, Jauharabad Sugar Mills Limited (JSML) reported a net profit of PKR 1.88 million (EPS: PKR 0.06, a decline from the previous year’s net profit of PKR 212.23 million (EPS: PKR 6.22).

Gross margins were adversely impacted, with the break-even bottom line due to elevated sugarcane prices. In the 4QFY24, lower sugar prices (PKR 120-125 per kg) and higher production costs prevented profit realization. Last year’s capacity utilization was approximately 70-80%, with an average conversion cost of PKR 20-22 per kg.

For the sugar segment, production is expected to remain consistent with the previous year, with an estimated supply and demand balance of 6.8 million tons. Jauharabad’s performance is expected to remain stable. Sugar prices are projected to increase this year, contrasting with last year’s depressed prices caused by delayed export approvals from the government. . The company sold its inventory of 24,000 tons of sugar during the December 2024 quarter, including 6,000-7,000 tons allocated for export.

The export sugar price to Afghanistan was approximately $510 per ton. Bagasse used internally for power generation, supported the company’s daily energy requirements of 6-7 MW, minimizing electricity costs in the financials.

Molasses recovery has declined across the industry due to improvements in sugar recovery rates, and it is expected to decrease further to around 4%. During this crushing season, sugarcane procurement prices increased from PKR 375 to PKR 400 per maund. Looking ahead, management expects normal profits in the sugar segment, with potential recovery in profitability. Export decisions will be finalized after confirming production figures in March-April 2025 and assessing demand. Domestic sugar prices have improved and are expected to rise to PKR 150 per kg.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose