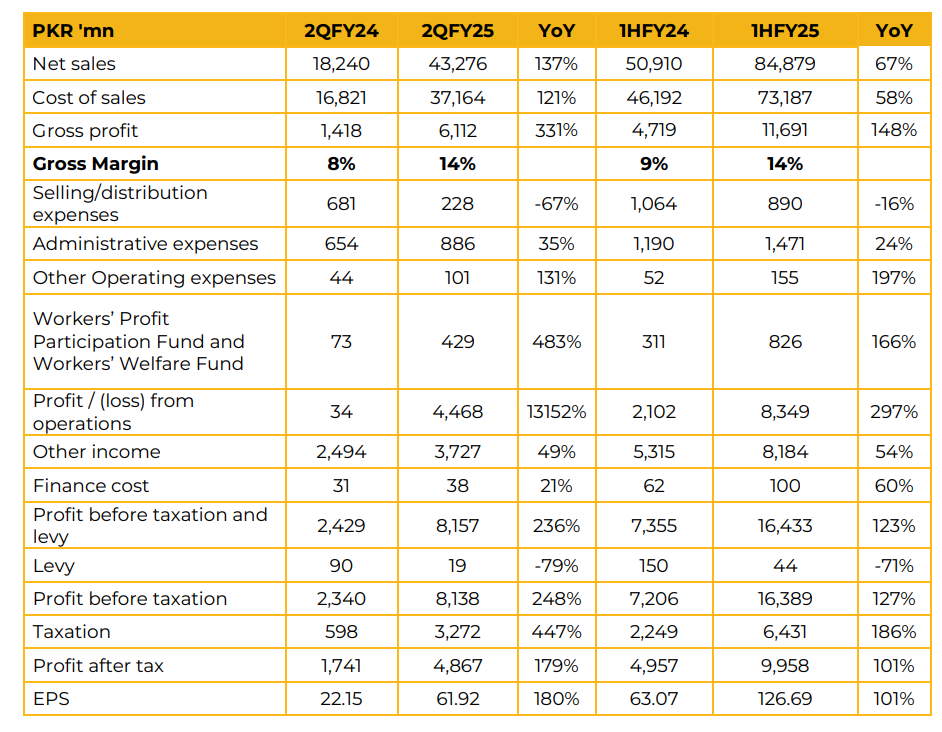

INDU reported a net profit of PKR 9.96 billion (EPS: PKR 126.69) in 1HFY25, reflecting a 101% YoY increase from PKR 4.96 billion (EPS: PKR 63.07) in 1HFY24. The earnings growth was driven by lower input costs due to favorable exchange rates, cost optimization initiatives, and increased localization efforts. Net sales turnover increased by 67% YoY to PKR 84.88 billion, compared to PKR 50.91 billion in the SPLY, primarily due to higher CKD and CBU sales volumes. Other income also rose, supported by higher returns on deposits and investments.

The overall auto market grew by 41%, with the CKD segment expanding by 55%. Used car sales remained stable at 17,000 units, while the passenger car (PC) segment posted 26% growth, with the economy and sedan segments growing by 34% and 37%, respectively. Commercial vehicle sales surged by 68%.

Management confirmed that there are no current plans for a stock split or share buyback. The company is awaiting further clarity on the EV policy. The Yaris facelift, launched in July 2024, has been well received in the market, contributing positively to profitability. In 1HFY25, INDU produced 12,525 units and sold 12,749 units, marking YoY growth of 96% and 74%, respectively. Management highlighted that 25% of the company’s energy costs are met through solar power, while rupee stabilization provided further margin support.

Regarding export plans under the Auto Policy 2021-2026, management stated that the 10% export target remains voluntary, with industry players considering exports of bulletproof vehicles. INDU reported no issues with LC openings this year. The Toyota Yaris GLI CVT remains the best-selling variant, particularly among corporate clients and banks, and is available for booking in April. Production is typically lower during Ramadan, reported by management. Localization efforts have reached 60-65% in passenger cars and 40-45% in SUVs, with further progress expected. The company’s installed production capacity stands at 76,000 units, expandable to 90,000 units with overtime.

However, due to current market conditions, production has been adjusted to 38,000 units on a single shift and 45,000 units with overtime.

The recent launch of the JAC T9 Hunter has boosted demand and bookings for the Toyota Hilux Vigo. Looking ahead, INDU anticipates economic recovery and strong growth, supported by lower interest rates and improved consumer confidence.

The EV policy remains under review, while the company plans to expand its hybrid vehicle portfolio, aligning with market demand. With strong cash flows, INDU is well positioned for future investments

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.