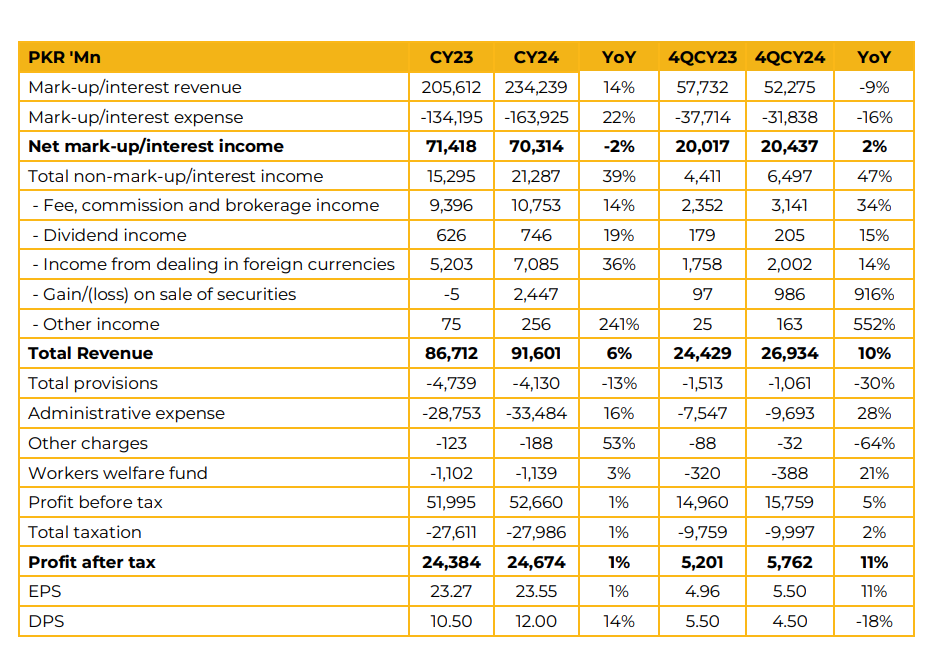

Habib Metropolitan Bank Limited reported unconsolidated earnings per share of PKR 23.55 in CY24 against earnings per share of PKR 23.27 in CY23, an increase of 1%. This translates into profit after tax of PKR 24.7 Bn in CY24 compared to PKR 24.4 Bn in CY23. The bank declared a dividend of PKR 12 per share in CY24 compared to PKR 10.5 in CY23. It is pertinent to note here that the bank now distributes dividend on a quarterly basis.

Total revenue in CY24 reached PKR 91.6 Bn against PKR 86.7 Bn in CY23, an increase of 6%. This was primarily driven by a 39% increase in non-mark-up income from PKR 15.3 Bn in CY23 to PKR 21.3 Bn in CY24. The bank saw its total deposits fall from PKR 1,012 Bn at the end of CY23 to PKR 927 Bn at the end of CY24, a drop of 8.4%. This was due to the shedding of fixed deposits to control costs.

Going forward, the management expects historical deposit growth of 10-15% will resume. Investments stood at PKR 811 Bn, down 12.4% from PKR 925 Bn last year. Advances were up 15.1%, reaching PKR 474 Bn, compared to PKR 412 Bn at the end of CY23. Management highlighted that its portfolio was 55% fixed rate (incl. TBills) and 45% floating rate. Out of the total portfolio of govt securities 38% is fixed rate PIBs with a return of 13.75% to 14.25% and an average tenure of 1.8 years. The bank’s cost to income ratio for CY24 stood at 38% compared to 34.6% in CY23. Management expects this to remain stable for CY25. Capital Adequacy Ratio stood at 19.29% up from 18.26% at the end of CY23. Advances to deposit ratio stood at 54.3% in Dec-24 up from 43.3% at the end of CY23. The management highlighted that its “Sirat” segment of Islamic banking has performed well with total branches now numbering 223 compared to 117 in CY23. Deposits also grew 38.5% from PKR 148 Bn in CY23 to PKR 205 Bn in CY24.

In the digital segment the bank saw tremendous growth in application subscribers from 472,000 users in CY23 to 629,000 users in CY24. Additionally, RAAST transactions value surged 86% from PKR 319 Bn in CY23 to PKR 592 Bn in CY24. Moving forward, the management expects the SBP to maintain a tight stance in order to keep inflation in check. As such, it expects net interest income to stabilize in the coming quarters.

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.