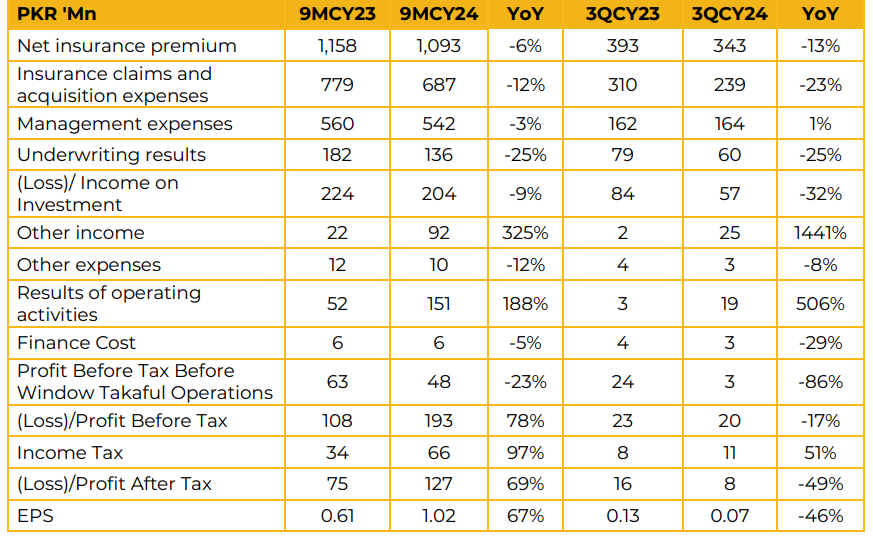

Habib Insurance Company Limited (HICL) reported a net profit of PKR 126.68 million (EPS: PKR 1.02) in 9MCY24, reflecting a 69% YoY increase from PKR 74.97 million (EPS: PKR 0.61) in 9MCY23. Net Insurance Premium for 9MCY24 declined by 6% YoY to PKR 1.09 billion, compared to PKR 1.16 billion in 9MCY23.

Gross Written Premium decreased to PKR 2.90 billion in 9MCY24, down from PKR 3.66 billion in the SPLY. However, management expects to close the year with GWP surpassing last year’s level. Equity stood at PKR 1.70 billion, while total assets reached PKR 6.23 billion in 9MCY24.

The growth in equity was attributed to unrealized gains amid a better-performing market. The portfolio mix for 9MCY24 comprises 40% fire, 32% motor, 15% marine, 13% miscellaneous, and 0.3% Group Health Premium (GHP). The motor segment witnessed a decline, dropping from 38% in the SPLY. Net claims improved to PKR 668 million in 9MCY24.

The investment portfolio is divided into 61% equity and 39% cash and government bonds. Management clarified that the company have not invested in mutual funds. In 3QCY24, overall Gross Underwritten Premiums grew by 7% YoY, with Conventional Premiums increasing by 8% and Takaful by 6%. The 3-year CAGR for the company’s premium reached 21.94%. Takaful Treaty Capacity was enhanced to PKR 2.5 billion.

Premiums underwritten through the Broker Partners’ Network recorded 30% growth during the period. Digital Channel alliances and partnerships resulted in a 232% YoY increase in Gross Premiums to PKR 58.9 million. The company also initiated its partnership with Indus Motor Company for the Toyota Protection Plan. Going forward, management expects the next year to remain challenging due to global economic and political uncertainties. The company plans to focus on business expansion while maintaining prudent underwriting practices and enhance investment income.

Management also indicated plans to announce a dividend by the end of the calendar year. HICL is in the process of developing a Direct Digital Platform and E-Commerce Website for retail product sales. Additionally, management anticipates securing higher reinsurance capacity in CY25 from its partners.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.