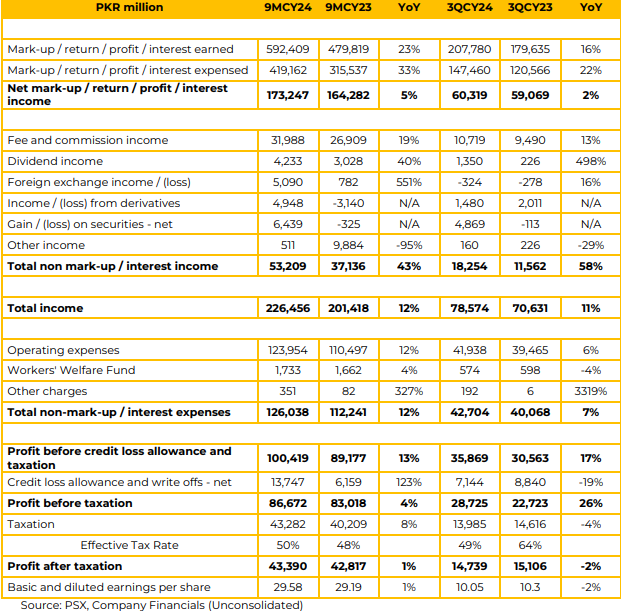

In 9MCY24, HBL reported profit of PKR 43.39 billion (EPS: PKR 29.58), reflecting a 1% YoY increase from PKR 42.81 billion (EPS: PKR 29.19) in the same period last year.

The bank achieved total Income growth of 12% YoY, reaching PKR 226.45 billion in 9MCY24, up from PKR 201.48 billion last year, driven by strong growth in both NII and non-markup income. NII rose by 5% YoY to PKR 173.24 billion in 9MCY24, driven by a 23% YoY increase in interest earnings, which reached PKR 592.40 billion. Non-markup income surged by 43% to PKR 53.20 billion, largely supported by fee and commission income, which totaled PKR 31.98 billion in 9MCY24.

Total income and Operating Expenses increased by 12% YoY, leading to a cost-to-income ratio of 56% in 9MCY24, same as the previous year.

Additionally, the infection ratio climbed to 6.2%, up from 5.8% in 1HCY24. The management anticipates the NPL ratio to improve with the gradual improvement in the economy.

On a consolidated basis, total deposits grew by 21% YoY to PKR 4.80 trillion. Management noted that the deposits tend to grow at a rate of 12-15% throughout the sector irrespective of the interest rate and they anticipate the same to follow for HBL. Similarly, the advances stood at PKR 1.8 trillion, translating into an ADR of 37.5%.

The management is confident to achieve the 50% mark by December 2024. In 9MCY24, HBL reported a CAR of 16.4%, ROA of 0.98%, and ROE of 16.6%. As of September 30, 2024, total assets stood at PKR 6.2 trillion.

The bank saw 14% growth in its customer base, reaching more than 37 million, and 41% YoY increase in digital transactions. In consumer lending, personal loans increased by PKR 2.9 billion to PKR 48 billion, card lending rose by PKR 7.5 billion to PKR 40 billion, and mortgages were up by PKR 3.3 billion to PKR 17 billion. However, auto finance declined by PKR 2.2 billion to PKR 33 billion in 9MCY24. Going forward, HBL is confident in achieving its ADR target of 50% by the end of CY24.

However, the management also expects to have a resolution of ADR target issue in future, as it creates distortion in the asset base of the bank. The management highlighted to maintain a prudent pay-out policy for a sustainable growth, unlike other major players paying out 80-90% of their earnings

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose