Gharibwal Cement, in its Corporate Briefing today, updated investors on various ongoing projects, including a 10,000 TPD expansion, a cooler retrofit, a 10MW solar power plant, and a 10MW multi-fuel power plant, for which a turbine has already been acquired.

Regarding the 10,000 TPD expansion, management confirmed the receipt of the pyro process plant, with civil work underway. They noted that the expansion pace would accelerate once interest rates decrease, but no definitive completion date was provided. The company estimated the project would require approximately PKR 16-17 billion for completion

The cooler retrofit is expected to be completed by the end of December 2024. This will increase the company’s capacity from 6,700 TPD to 7,500 TPD and reduce coal consumption by 3-4%.

The retention price stands at PKR 850/bag, while the current MRP is PKR 1,430/bag. The company is currently not exporting to Afghanistan due to unfavourable prices.

GWLC expressed concerns over Flying Cement Company’s expansion plans, though management does not anticipate a price war.

The 10 MW solar power project became operational in FY24, with an additional 8MW expected to come online by 3QFY25. The capex for this project is PKR 550 million.

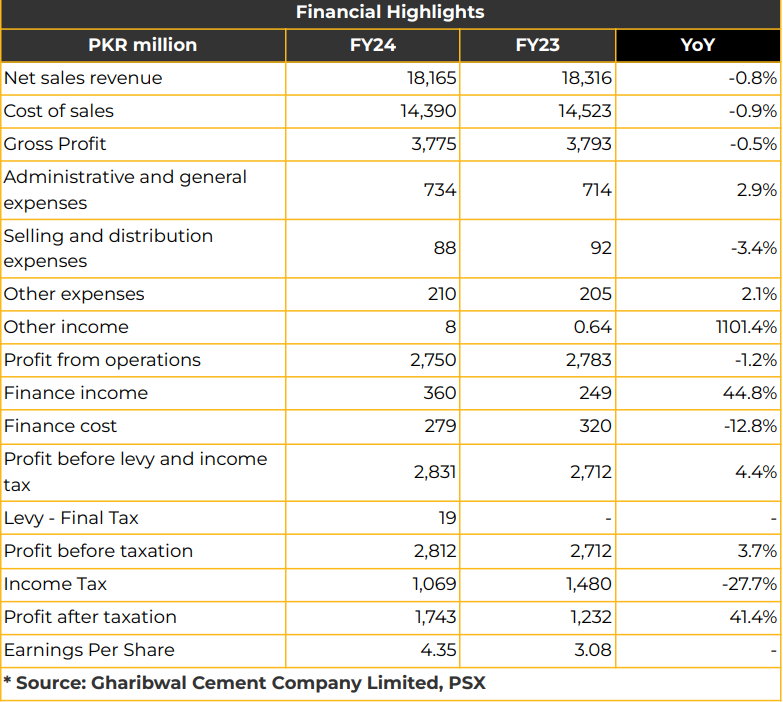

In FY24, Gharibwal Cement Limited reported a net profit of PKR 1.74 billion (EPS: PKR 4.35), reflecting a 41% YoY increase from PKR 1.23 billion (EPS: PKR 3.08) in the prior year. However, revenue slightly decreased by 0.8% YoY to PKR 18.17 billion.

Cost of sales decreased by 0.9% YoY to PKR 14.39 billion in FY24. Other expenses declined by 6% YoY to PKR 49.68 million in 1QFY24, while finance costs fell 13% YoY to PKR 279.38 million in FY24, down from PKR 320.23 million in the SPLY.

GWLC reported dispatches of 1.35 million tons in FY23, a 20% YoY decline from 1.68 million tons in the SPLY, driven by reduced capacity utilisation (61% in FY23 vs 76% in FY22). The current retention price of cement stands at PKR 15,000.

Net sales increased by 13% in FY23 to PKR 18.32 billion, up from PKR 16.19 billion in the SPLY, driven by a 41% YoY rise in the average selling price per ton. Financial expenses fell 55% YoY to PKR 72 million in FY23.

In FY23, GWLC’s net profit decreased by 9% YoY to PKR 1.23 billion (EPS: PKR 3.08) from PKR 1.36 billion (EPS: PKR 3.38) in the SPLY.

The company’s fuel mix consists of local coal (20%), Afghan coal (58%), and imported coal (22%), with an average coal cost of PKR 48,000 per ton.

GWLC’s power mix is as follows: WHR & CFB (50%), National Grid (31%), and HFO (19%). The company is not using gas for production due to cost and availability issues, with the average power cost reported at PKR 23 per unit.

Going forward, GWLC expects prices to remain stable, with a slight pickup in demand anticipated.

Important Disclosures

Disclaimer:

This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for

information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or

solicitation or any offer to buy. While reasonable care has been taken to ensure that the information

contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes

no representation as to its accuracy or completeness and it should not be relied upon as such. From

time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws,

have a position, or otherwise be interested in any transaction, in any securities directly or indirectly

subject of this report Chase Securities as a firm may have business relationships, including investment

banking relationships with the companies referred to in this report This report is provided only for the

information of professional advisers who are expected to make their own investment decisions without

undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or

indirect consequential loss arising from any use of this report or its contents At the same time, it should

be noted that investments in capital markets are also subject to market risks This report may not be

reproduced, distributed or published by any recipient for any purpose.