Key Takeaways:

● Mari Gas Prices Projected to Remain Steady

● FFBL-FFC Merger Nears Final Approval, Completion Expected by Year-End

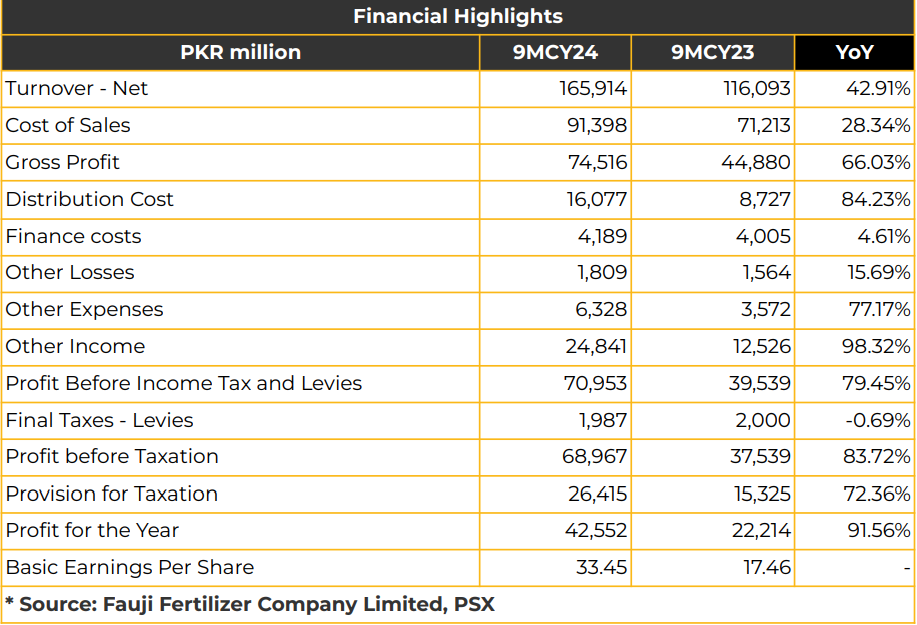

In 9MCY24, Fauji Fertilizer Company Limited (FFC) reported an unconsolidated net profit of PKR 42.55 billion (EPS: PKR 33.45), a 92% YoY increase from PKR 22.21 billion (EPS: PKR 17.46) in the SPLY. This rise in profitability was mainly driven by dividends (PKR 8 billion) and investment income (PKR 9.9 billion) in 9MCY24.

Management reported that dividend and investment income contributed 42% to profitability, up from 38% last year. However, FFC expects investment income to decline as interest rates decrease. FFC received PKR 1.5 billion in dividends from its fertilizer business, PKR 7.5 billion from energy, and PKR 1.6 billion from services.

Consolidated net turnover rose 43% YoY to PKR 165.91 billion in 1HCY24, compared to PKR 116.09 billion in SPLY. The group revenue was primarily driven by FFC contributing PKR 166 billion, PKR 13 billion from energy, and PKR 6 billion from food. Other income reached PKR 16 billion, with FFC’s contribution at PKR 14 billion.

Profit from associates totaled PKR 22 billion (PKR 6 billion in SPLY), with FFBL contributing PKR 12 billion, AKBL PKR 7 billion, and others PKR 3 billion. The group’s profitability reached PKR 60.3 billion in 9MCY24, 67% up YoY, compared to PKR 36.4 billion in SPLY. The combined DAP market share for FFC and FFBL declined to 66%, from 70%. FFC imported 54KT in 3QCY24, 31% down, compared to 78KT in SPLY, while FFBL imported 27KT in 3QCY24. FFC’s Sona DAP imports stood at 544KT in 3QCY24, 12% down from 619 KT in SPLY.

Sona Urea market share improved to 51% in 3QCY24, from 44% in SPLY. FFC’s Sona Urea offtake was 1,958KT in 3QCY24, 2% up from 1,911 KT in SPLY, with FFC importing 95KT. FFBL’s Sona G offtake rose 43% to 361 KT in 3QCY24, from 253 KT in SPLY. Management cited that Sona Urea market shares increased due to a stable gas supply.

Industry closing inventories of DAP rose to 366KT, from 38KT in SPLY, while industry urea sales fell to 964 KT, from 992 KT in SPLY. Industry closing inventories of Sona Urea increased to 600KT, from 77KT in SPLY, while industry sales declined by 7% to 4,604 KT, from 4,945 KT in SPLY. Management anticipates inventory levels to decrease by year-end, supported by reduced prices.

The standard industry inventory level is 400,000 tons for urea and 100,000 tons for DAP, helping reduce imports and conserving foreign exchange reserves. FFC launched 70 direct-to-farmer stores to ensure timely access to high-quality fertilizer at controlled rates.

Management reported that 50,000 farmers are now registered, with 0.6 million acres under cultivation. FFC expects these outlets to account for 2-7% of total sales volume going forward. During 9MCY24, management reported a USD 320 million benefit passed on to farmers due to lower urea prices (PKR 4,275) compared to international prices (PKR 6,400). The potential merger of FFBL into FFC has received CCP and shareholder approval, with the next hearing scheduled for November 18, 2024. Upon court approval, regulatory processes will be completed, with the merger expected by the end of CY24.

FFC holds a 30% stake in AGL and announced a public offer for AGL acquisition in late October. The regulatory process has begun, with documents shared with regulators.

Management expects to conclude the acquisition by January 2025. Management reported that the two key challenges are achieving turnaround and security of gas supply after the acquisition. Going forward, management anticipates a rise in international prices due to the ongoing geopolitical tension and intends to pay dividends following the merger and acquisition.

The company also forecasts sales to reach 2.4 million tons by the end of CY24 and aims to reduce inventories during CY24. Management indicated that the AKBL will continue as a conventional bank. Management anticipates that the import of all compressors for the Pressure Enhancement Facility will be completed by 2QCY25, with project completion targeted for the end of CY25. Additionally, management expects to maintain an inventory of 400,000 tons next year, aligning with the industry benchmark. Management expects the Mari gas prices to remain unchanged.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.