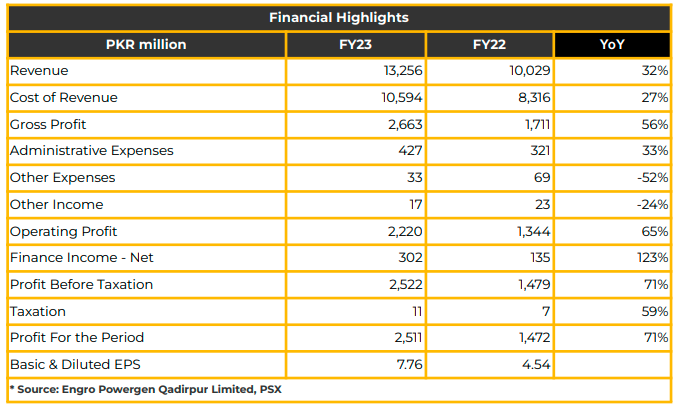

In CY23, Engro Powergen Qadirpur Limited reported a net profit of PKR 2.51 billion (EPS: PKR 7.76), marking a substantial improvement compared to the PKR 1.47 billion net profit (EPS: PKR 4.54) in the corresponding period of the previous year.

The company’s revenue for CY23 reached PKR 13.26 billion, demonstrating a significant 32% year-on-year growth from the PKR 10.03 billion reported in the same period the previous year. Throughout CY23, gross profit experienced a 56% year-on-year increase to PKR 2.66 billion, while the cost of sales rose by 27% year-on-year to PKR 10.59 billion.

The gross profit margin for CY23 was reported at 20.09% (compared to 14.33% in FY22), reflecting an improvement from the previous year.

Administrative expenses decreased by 33% year-on-year to PKR 426.51 million due to higher inflation, while other expenses decreased by 52% year-on-year to PKR 33.21 million during the same period. Net finance income rose to PKR 302.02 million in CY23, attributed to higher interest rates compared to PKR 135.18 million in CY22.

EPQL received approval for modification in the General License to include gas to be supplied by Petroleum Exploration Limited (PEL). The price of this low BTU gas is reported at USD 5.6 per MMBtu, with the supply agreement spanning three years, as per management.

EPQL ensured plant availability at 100% and received continuous dispatches due to a high merit order position in CY23. Additionally, the management ensured an exceptional safety record, reaching a safety streak of 5,000 consecutive days without a lost workday Injury (LWI) since CoD.

Billable availability factor increased to 100% in CY23 compared to 93% last year. Net electrical output increased to 870 GWh in CY23 from 768 GWh in CY22. Similarly, the load factor also increased to 46% during the same period from 41% in the previous year.

The total receivables position of EPQL improved in CY23, enhancing the liquidity position of the Company. The receivables the company received in four quarters are as follows: PKR 12.86 billion, PKR 12.27 billion, PKR 10.99 billion, and PKR 10.53 billion, higher than last year.

Going forward, the management indicated it would continue engagement with regulators and stakeholders to finalize an alternate fuel option. Afterward, the management is likely to focus on finalizing the Gas Supply Agreement with PEL while exploring other local fuel options. Regarding dividends, management aims to sustain the current level of dividends and payout ratio.

The management anticipates power demand to remain subdued due to macroeconomic challenges and expects the plant to continue receiving dispatches despite the cheaper electricity generated by EPQL.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.