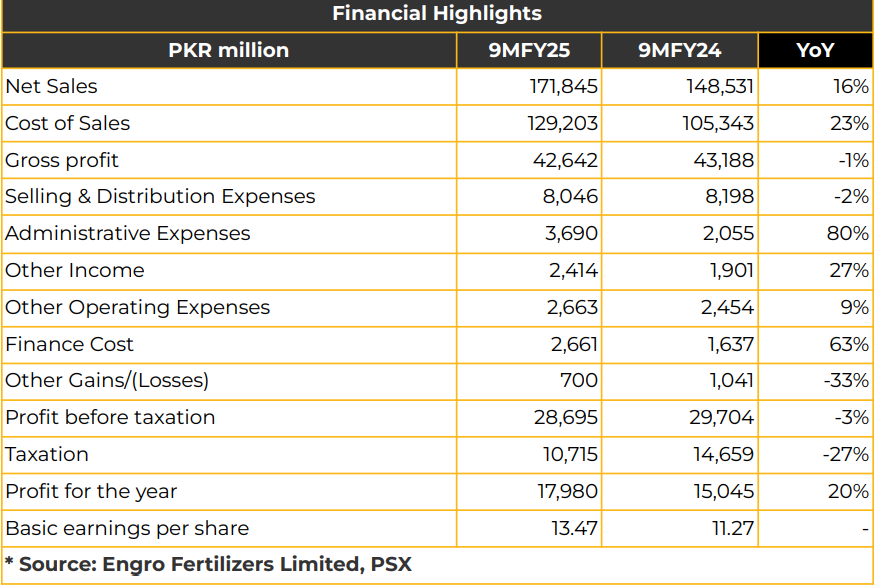

In 3QCY24, EFERT reported a net profit of PKR 8.55 billion (EPS: PKR 6.41), marking an 11% YoY decline from PKR 9.58 billion (EPS: PKR 7.17) in the corresponding period last year. The company declared a dividend of PKR 2.50/share, down from PKR 6/share in the SPLY, attributed to a higher dividend payout in the prior quarter despite lower earnings, prompting a reduced dividend in the outgoing quarter. Revenue increased by 11% YoY to PKR 58.64 billion in 3QCY24, compared to PKR 66.16 billion in the SPLY, while gross profit rose 13% to PKR 18.31 billion in the same period. The decline in profitability was linked to the EnVen Plant’s largest turnaround in 2QCY24 and farm economics and slow economy in 3QCY24. Urea production stood at 577 KT in 3QCY24, 4% down from 600 KT in SPLY, while urea sales dropped to 466 KT from 692 KT in SPLY. For 9MCY24, production and sales of urea declined to 1,543 KT (1,716 KT in SPLY) and 1,321 KT (1,726 KT in SPLY), respectively. EFERT’s market share fell to 30% (38% in SPLY), while FFC’s share increased to 47% from 40%. The decline in urea sales was driven by weak farm economics and higher prices, prompting EFERT to reduce urea prices per bag to incentivize dealers and farmers. Management highlighted continuous operations of LNG plants and urea imports creating an oversupply in the market, with industry-wide urea inventory rising to 619 KT in 3QCY24 (78 KT in 2QCY24) and DAP inventory reaching 400 KT (84 KT in 3QCY23). EFERT also offered off-season sales incentives for urea. The industry saw a 17% YoY drop in urea sales to 1,535 KT (1,844 KT in SPLY), while DAP sales fell 21% to 385 KT from 487 KT in the SPLY. EFERT’s DAP market share improved by 2% YoY, reaching 18% in the same period. Management expects lower interest rates, inflation, and the Kissan card scheme to reduce farmers’ input costs. Despite a gas price hike in March 2024, EFERT urged the government to unify gas pricing across the industry, noting that the increase only impacted 60% of the

sector, exacerbating cost disparities. The Pressure Enhancement Facility (PEF) Project Phase-I is 90% complete, with full completion expected by the end of Q4CY24. Phase II preparations are underway, with compressors ordered. EFERT has allocated 20% of the total CAPEX for Phase I and will utilize the remaining 80% for Phase II, which is expected to be completed by 2QCY25. EFERT holds a 33% stake in the PEF project, with total CAPEX estimated at USD 300

million. EFERT recently launched the AI-powered UgAi App, allowing farmers in Sindh to procure its products

directly from warehouses, with plans to expand the service to other regions. Additionally, EFERT aims to open 4-5 direct sales shops for farmers. The GIDC case remains unresolved, with no court decision yet. Going forward, management expects production to normalize in the next quarter. Discussions are ongoing with the government regarding discriminatory gas pricing, and EFERT anticipates weak demand for CY24 due to farmers’ liquidity constraints and private

importers’ inventory pressure on the supply side.

Important Disclosures

Disclaimer:

This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for

information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or

solicitation or any offer to buy. While reasonable care has been taken to ensure that the information

contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes

no representation as to its accuracy or completeness and it should not be relied upon as such. From

time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws,

have a position, or otherwise be interested in any transaction, in any securities directly or indirectly

subject of this report Chase Securities as a firm may have business relationships, including investment

banking relationships with the companies referred to in this report This report is provided only for the

information of professional advisers who are expected to make their own investment decisions without

undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or

indirect consequential loss arising from any use of this report or its contents At the same time, it should

be noted that investments in capital markets are also subject to market risks This report may not be

reproduced, distributed or published by any recipient for any purpose.