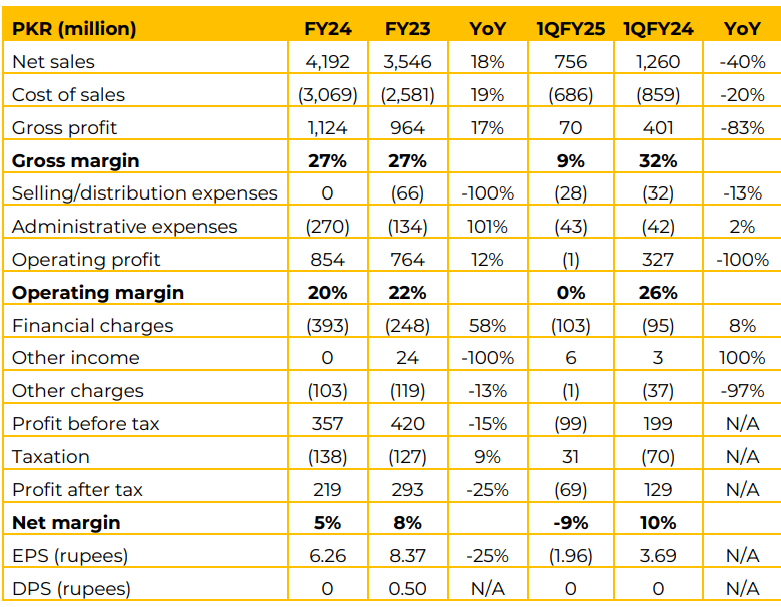

Emco Industries reported net sales of PKR 4,192 million for FY24, reflecting an 18% year-over-year (YoY) increase compared to PKR 3,546 million in FY23.

However, 1QFY25 sales sharply declined by 40% YoY to PKR 756 million, down from PKR 1,260 million in 1QFY24, due slowdown in demand. Gross profit grew 17% YoY to PKR 1,124 million, maintaining a stable gross margin of 27%. Gross profit plummeted by 83% to PKR 70 million.

This led to a significant contraction in the gross margin to 9%, from 32% in 1QFY24. EPS declined by 25% YoY to PKR 6.26 in FY24 from PKR 8.37 in FY23, while no dividends were declared for the year, compared to a payout of PKR 0.50 per share in the prior period. In 1QFY25, EPS turned negative at PKR -1.96, reflecting the net loss during the quarter. The company is the largest manufacturer of Porcelain Insulators in Pakistan.

The company is also the only manufacturer of High Voltage Disconnect Switches and Surge Arresters. The company is also engaged in the manufacturing of Instrument Transformers. The company enjoys contracts with major power distribution companies for RTV coating of insulators. The company has also integrated in metal works of allied products to cater the requirement of existing customers.

The company has established another high voltage laboratory (highest capable laboratory in the private sector), which would be used for testing of high voltage lines up to 600KV. The company is in process of acquiring ISO-17025 certification for its laboratory.

Going forward, the company is looking to expand its exports. However, margins are expected to remain volatile as company is carrying out BMR projects and enhancing product portfolio. Apart from NTDC, provinces are establishing their independent T&D companies. Moreover, with the ADB and World Bank funding the upgradation of transmission and distribution network, the management expects good demand to unfold in the near future.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.