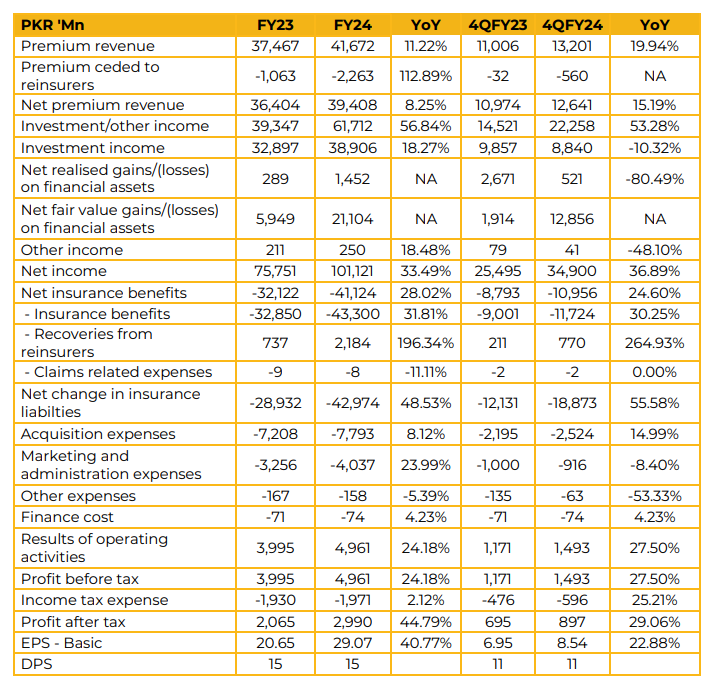

EFU Life Assurance Limited (EFUL) reported earnings per share (EPS) of PKR 29.07 for CY24, compared to PKR 20.65 in FY23. During the year, the company declared a dividend of PKR 15 per share, maintaining the same level as in CY23.

The company’s product portfolio includes life and health insurance, conventional and Takaful products, along with savings and protection plans. In 2024, EFU Life introduced several innovative financial solutions through branchless banks, telecom providers, microfinance institutions, and technology platforms.

The company also launched a wellbeing initiative under the brand WIN and introduced its first participating product within the Aasaan product range. EFU Life’s asset composition consists of 71% government securities, 19% shares and mutual funds, and 10% other investments.

However, the ongoing issue of sales tax on gross premiums is expected to have a negative impact on the life insurance business, potentially affecting business continuity and future dividend payments. The Securities and Exchange Commission of Pakistan (SECP) has set a target for insurance companies to achieve 30% of their premium composition through Takaful within five years. Currently, EFU Life’s portfolio comprises 35% individual life business, around 19% corporate life business, and approximately 13% corporate health business.

The management remains confident in meeting SECP’s target. Notably, in Khyber Pakhtunkhwa (KPK) and Balochistan, the individual life business has recently been converted into Takaful. As the sole Takaful provider in KPK, EFU Life expects this to positively contribute to its growth. Additionally, life insurance companies are required to raise their capital to PKR 3 billion by 2030. EFU Life’s management is optimistic about meeting this requirement.

The company is also in discussions with the government to reinstate tax credits to encourage a culture of saving. Looking ahead, the management plans to launch Voluntary Pension Schemes (VPS) and annuity solutions.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.