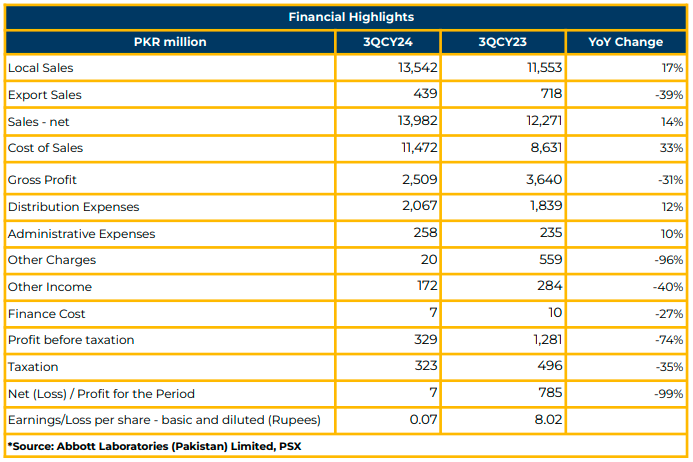

In 3QCY23, Abbott Laboratories (Pakistan) Limited reported a net income of PKR 6.67 million (EPS: PKR 0.07), marking a significant decrease from PKR 784.97 million (EPS: PKR 8.02) in the corresponding period last year.

Net sales for 3QCY23 were PKR 13.98 billion, reflecting a 14% YoY increase from PKR 12.27 billion in SPLY. The company’s local sales surged by 17% YoY to PKR 13.54 billion in 3QCY23 compared to PKR 11.55 billion last year.

However, Abbott’s exports registered a decrease of 39% YoY to PKR 439.79 million in 3QCY23 compared to PKR 717.84 million in SPLY. Gross profit witnessed a decline of 31% YoY to PKR 2.51 billion during the said period.

Cost of sales increased by 33% YoY to PKR 11.47 billion, whereas administration and distribution expenses increased by 10% YoY and 12% YoY to PKR 257.80 million and PKR 2.07 billion in 3QCY23. The finance cost of the company decreased by 27% YoY to PKR 7.09 million compared to PKR 9.76 million in SPLY.

In 9MCY23, the overall revenue of the company increased by 12% YoY to PKR 41.23 billion. The company witnessed a gross profit margin of 20% and a net loss of 2% in 9MCY23. The revenue of the pharmaceutical, diagnostics and other segments increased by 18% YoY, 20% YoY and 21% YoY, reaching PKR 27.42 billion, PKR 3.65 billion and PKR 1.18 billion respectively. However, the nutritional segment witnessed a drop in revenue by

7% to PKR 8.98 billion in 9MCY23, primarily due to the lower purchasing power of the consumers.

Overall gross profit margins decreased by 13% YoY in 9MCY23, while those for the pharmaceutical, nutrition, diagnostic and others segments were reported at 32%, 40%, 14% and 39% respectively, in 9MCY23.

In FY22, the topline of the company witnessed a growth of 16% YoY to PKR 49.26 billion. However, devaluation and inflation impacted the profitability of the company.

Gross profit margin and net profit margin were reported at 29% and 6% in CY22.

During CY22, pharmaceutical sales increased by 14% YoY, nutrition sales by 23%, diagnostic sales by 9% and others by 9%. The gross profit for each of the segments decreased due to massive devaluation, higher inflation, and revised cost.

The current product mix is 45% essential products and 55% non-essential products. Management aims to maintain a market share of 5%. Moreover, Abott maintains an inventory of ninety days.

Additionally, there was no progress on the hardship cases pending for the last two years. Additionally, CPI adjustment was not provided by the government this year. It is expected to be received in July next year as pharmaceutical companies negotiate with regulatory and government bodies. However, the one-off price adjustment granted to pharma companies earlier this year was not sufficient to cover the higher costs incurred by the companies due to devaluation and higher inflation.

Going ahead, the management anticipates a continued margin decline if devaluation and inflationary situations persist in the country. Moreover, Abbott is engaged with a Spanish company for biosimilar drugs, expected in the next two years.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect

consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.