Key Takeaways:

• Increasing market penetration; manufacturing PET bottles for edible oil, cleaning agents, bottled water.

• Rise in demand of local brand is increasing the company’s customer base.

• Management expects improvement in sales and profitability going forward.

• Company is also expanding its manufacturing capacity.

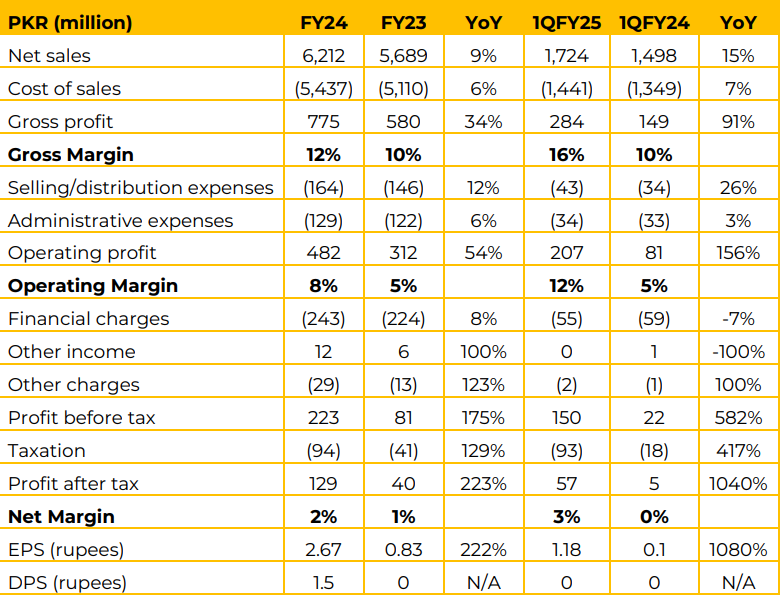

Ecopack Limited’s net sales for FY24 stood at PKR 6,212 million, reflecting a YoY growth of 9%, driven by increased demand. In 1QFY25, net sales rose 15% YoY to PKR 1,724 million, showcasing sustained revenue momentum. . Earnings per share (EPS) for FY24 grew to PKR 2.67 (+222% YoY), while 1QFY25 EPS spiked to PKR 1.18 (+1,080% YoY).

A dividend per share (DPS) of PKR 1.5 was announced for FY24, marking a resumption of payouts. EcoPack is the premier vendor for internationally renowned brands i.e. Pepsi, Coca Cola & Unilever as well as leading national brands like Muree Group, Sparklets, Hamdard Rooh Afza, Qarshi Jam-e-Shireen, Gourmet Cola, Punjab Oils, Shama Oils, Springley, Pivrifine Water etc. PET bottles have wiped-out glass bottle from the soft drinks industry. In 1990s the PET bottles used to have 5- 10% share. Today, glass bottles share is reduced to 10-12% only.

Some of the factors positively impacting the company’s revenue include, introduction of smaller sized bottles for Carbonated Soft Drinks (CSD), conversion of pharmaceutical products from glass to PET bottles, hot filled heat resistance bottles for Juice and Energy drinks and a signifcant surge in demand by the local brands due to geo-politcal reasons. Some of the major customer segments include: Carbonated Soft Drinks, Syrup Squashes & Concentrates, Bottled Water, Juices, Pharmaceutical, Edible Oil and Cleaning agents. Going forward, Ecopack Limited expects growth from improved sales across existing and new segments, including bottled water, edible oil, and pharmaceuticals. The ‘Large Bottle Project’ supports diversification, catering to bottles from 2 to 16 liters.

The 500-kW solar project has been successfully implemented, with plans for scaling up and exploring additional energy alternatives to reduce grid dependency. The company’s expanded customer base, driven by rising demand for national brands, and the 20-25% planned manufacturing capacity expansion by June 2025 are expected to boost both revenue and profitability

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.