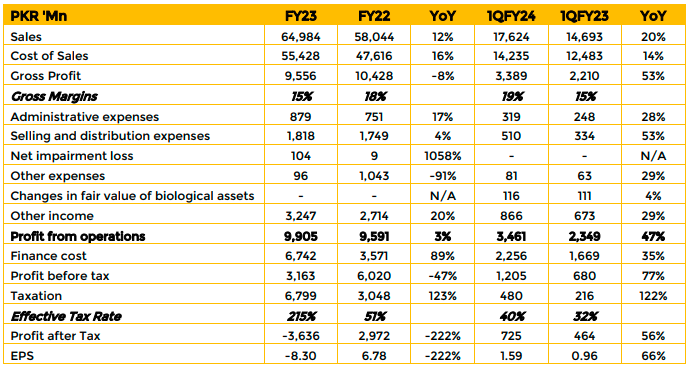

During FY23 net revenue for the company clocked in at PKR 64.98 Bn, an increase of 12% against PKR 58 Bn in FY22. However, gross profit fell to PKR 9.56 Bn in FY23 compared to PKR 10.4 Bn in FY22 registering a decrease of 8.4%. Profit from operations stood at PKR 9.9 Bn in FY23, up 3.3% compared to PKR 9.6 Bn in FY22.

Finance costs for FY23 were reported at PKR 6.74 Bn against PKR 3.57 Bn in FY22, an increase of 88.8%. This was primarily due to the higher benchmark rate set by SBP.

Profit before tax fell 47.5% in FY23 to PKR 3.16 Bn from PKR 6 Bn. The company suffered a loss after tax of PKR 3.6 Bn in FY23 compared to a profit after tax of PKR 2.97 Bn. Breakup Value per share fell 8% from PKR 159.59 in FY22 to PKR 146.52 in FY23.

The company has two subsidiaries, Nishat Paper Products Company Limited (NPPCL) and Nishat Dairy Private Limited (NDPL).

In FY23, NPPCL had a revenue of PKR 3.1 Bn and incurred a loss of PKR 177 Mn. NPCCL currently possesses 3 main production lines with 220 million paper bags capacity and aims to add 90 million polypropylene bags capacity to meet the growing demand. It would ideally dispose of 2 paper production lines as it sees the market using PP bags more in the future.

In FY23, NDPL made a revenue of PKR 4.9 Bn and profit of PKR 491 Mn.

Going forward the company expects demand for cement to remain flat in FY24 before moving on to recover 10-15% in FY25.

The imposition of axle load restrictions have impacted margins and therefore the company has increased prices in an attempt to pass on the increase in costs. Retail prices are now at PKR 1,260 per bag in the North and PKR 1,100 per bag in the South.

The company is hopeful of increasing its exports to the US and Mexico in order to have stable sales volumes. Clinker exports prices are at USD 30-31 per ton.

The company’s energy mix utilizes 70% of its own generation and 30% through the national grid. It pays about PKR 41 plus sales tax per unit of electricity purchased from the grid.

The company expects finance costs to continue to bite into profits in the near future due to high levels of inflation and a high policy rate set by SBP. It also expects new capacities coming online to increase competition.

DGKC is also wary of the new IMF agreement that will be required in CY24 and conditions attached to it which could impact sales in the construction sector.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose