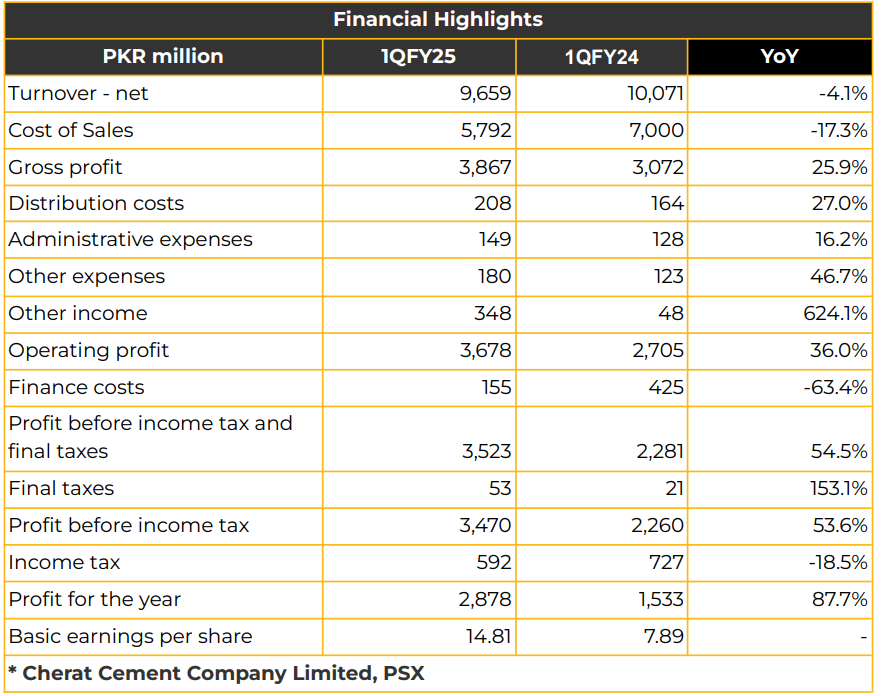

In 1QFY24, Cherat Cement Company Limited (CHCC) achieved a net profit of PKR 2.88 billion (EPS: PKR 14.81), reflecting an 88% YoY increase from PKR 1.53 billion (EPS: PKR 7.89) in the same period last year. This growth was driven by cost-saving measures, reduced finance costs, and improved retention.

Net sales declined by 4.1% YoY to PKR 9.66 billion, down from PKR 10.07 billion in the corresponding period of the previous year.

Despite this, gross profit rose by 26% YoY to PKR 3.87 billion. In FY24, industry export dispatches to Afghanistan increased by 36.4% to 1.5 MT, while sea exports grew 62% YoY to 5.7 MT. However, local dispatches declined by 4.5% YoY. Total dispatches across the industry rose by 1.6% YoY, reaching 45.3 MT. CHCC’s own local dispatches fell by 13% YoY to 2.2 MT, while export sales increased by 0.41 MT.

Total dispatches for CHCC, however, decreased by 8.5% YoY to 2.6 MT in FY24. The export price of OPC stood at USD 50 per ton. CHCC’s gross turnover increased by 4% YoY in FY24, reaching PKR 52.32 billion, primarily due to higher export sales.

Gross profit rose by 17% YoY to PKR 11.84 billion, and operating profit increased by 15% YoY to PKR 10.61 billion. Net profit also grew by 25% YoY to PKR 5.50 billion (EPS: PKR 28.31), up from PKR 4.40 billion (EPS: PKR 22.67) in the previous year. As of June 2024, the per-ton cost for CHCC was PKR 10,124, with fuel and power costs at PKR 6,176, raw and packaging materials at PKR 1,796, fixed costs at PKR 1,586, and store consumption at PKR 566. Financing costs decreased by 28% YoY to PKR 1.38 billion in FY24, aided by the repayment of expensive commercial loans, leaving only concessional loans. Excess liquidity was invested in mutual funds, boosting interest income.

Short-term borrowings were limited to PKR 1.9 billion. CHCC’s solar capacity is 13.56 MW, and the company plans to add another 9 MW, with commissioning expected in 3QFY25 at a cost of PKR 1.4 billion. This will increase total solar capacity to 22.56 MW, while total renewable energy capacity will reach 45.06 MW. The company also has 19.5 MW WHR installed across cement lines and an additional 3 MW at the Gunset plant.

Solar efficiency is reported at 22-23%. CHCC’s power mix includes PGD-Gas (49.9%), WHR (37.2%), PGD-FO (0.02%), PEDO (3.68%), PESCO (0.6%), and Solar (8.6%). The fuel mix comprises 59.3% local coal, 22.2% Afghan coal, and 18.5% imported coal.

The company benefits from a trilateral PEDO supply agreement, especially during summer months, at a rate of PKR 16-18 per kWh. As of June 30, 2024, CHCC’s debt-to-equity ratio improved to 16:84, from 49:51 in the previous year. ROE and ROCE stood at 23.69% and 18.58%, respectively, and the gross profit margin was 30.81%.

The company’s installed capacity is 4.5 million tons annually, split across Line I (1.1 MT), Line II (1.3 MT), and Line III (2.1 MT). CHCC offers ordinary portland cement and Portland cement composite, with the latter only supplied to the KPK region. Gross margins improved due to efficient power and fuel mix utilization. Expansion plans for Line IV are under consideration but are currently on hold.

Management highlighted that CHCC has a strategic advantage in KPK with better gas availability, secured by a Peshawar High Court order. The maximum retail price (MRP) is PKR 1,450 per bag, and grid power rates are PKR 38-40 per kWh. Local coal comprised 60% of coal use in 1QFY25, with flexibility to use up to 90% based on price and availability. The gas tariff increased to PKR 3,000 per MMBtu, but CHCC remains cost-efficient, with a per-unit cost of PKR 28-30. Looking forward, CHCC expects cement demand to recover, driven by government PSDP spending, should economic conditions improve due to lower inflation and policy rates. Management anticipates a positive shift in local demand for FY25.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.