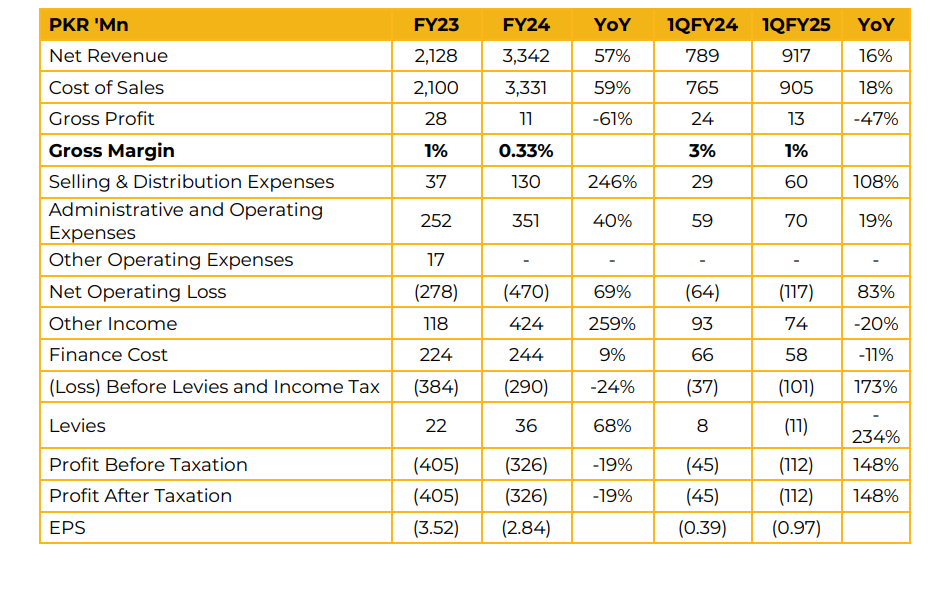

In FY24, Chenab Limited (CHBL) reported a net loss of PKR 326.21 million (LPS: PKR 2.84) compared to a net loss of PKR 405.14 million (LPS: PKR 3.52) in the SPLY. In 1QFY25, the company recorded a net loss of PKR 111.82 million (LPS: PKR 0.97), higher than the net loss of PKR 45.03 million (LPS: PKR 0.39) in the SPLY.

The management disclosed that Chenab Limited is operating at 25% unit utilization. To optimize production capacity, the company is engaged in toll manufacturing of fabrics for the local market. Gross profit for FY24 stood at PKR 10.87 million, impacted by higher fixed costs.

The increase in freight costs, driven by the Red Sea crisis, further escalated selling and distribution expenses. Other income rose due to the sale of a non-core asset under a scheme of arrangement. The proceeds were allocated 75% to debt repayment to banks and 25% for working capital requirements.

To further improve working capital, the directors injected approximately PKR 800 million into the company. Finance costs included prior mark-up, which will be paid after the principal amount, scheduled to be repaid over the next 14 years.

Looking ahead, the company expects to increase sales and improve gross profit margins by reducing fixed costs, leveraging banking channels, and enhancing working capital utilization.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.