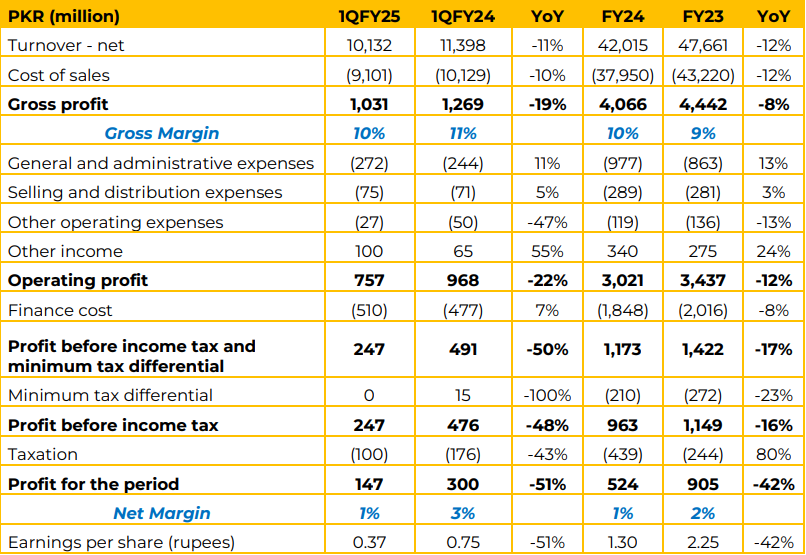

The company’s turnover decreased by 11% YoY from PKR 11,398 million in 1QFY24 to PKR 10,132 million in 1QFY25. This decline is consistent with the full-year performance as well, with FY24 turnover down by 12% compared to FY23.

This drop in revenue indicates decrease in sales volume due to low market demand, which is influenced by external economic factors and competitive pressures due to dumping of Chinese product in the Pakistani market and capacity expansions by competitors.

The gross margin fell slightly from 11% in 1QFY24 to 10% in 1QFY25. This decrease in gross profit margin reflects potential pricing pressures and increased cost inefficiencies due to low-capacity utilization on machines. For the full year, gross profit declined by 8%, with the gross margin at 10% in FY24, slightly above the 9% recorded in FY23. Net profit for 1QFY25 declined by 51% to PKR 147 million from PKR 300 million in 1QFY24. For the full year, net profit dropped by 42%, from PKR 905 million in FY23 to PKR 524 million in FY24.

Consequently, the net margin contracted to 1% both in the quarter and for the full year. The company holds 11% share in the total paper & board market, whereas other peers hold 13% market share. In coated duplex board, the company holds a majority 43% market share and in bleach boards it holds 14% market share.

The company faces a major challenge and fierce competition due to cheaper imports from China mainly in the coated bleached board segment. The company has filed for anti-circumvention investigation in order to get antidumping tariff applied on these imports. Total 7 machines were operational, each dedicated for each product.

However, due to low-capacity utilization the company has decided to run lesser machines with full capacity by shifting the other products on these machines. This will help to achieve efficiency and will optimize cost, thereby reducing the burden on gross margins.

Going forward, the management expects growth in paper & board consumption in Pakistan, since the current consumption in Pakistan stands at only 5kg per capita, however internationally it is 75-200kg per capita. Moreover, the management expects the gross margin to remain at same level in the upcoming quarter.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.