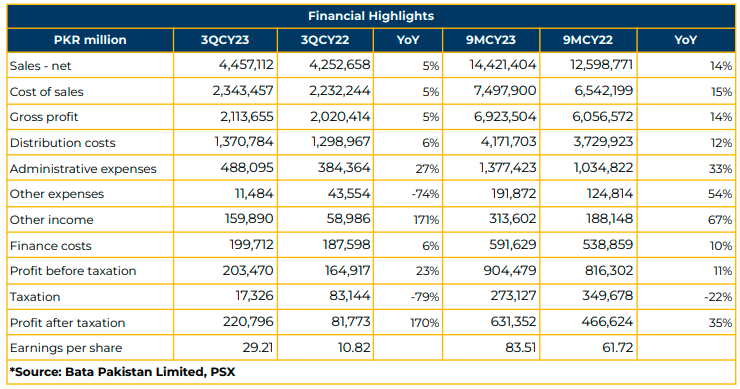

In 9MCY23, Bata Pakistan Limited reported a net profit of PKR 631.35 million (EPS: PKR 83.51), marking a significant increase from PKR 466.62 million (EPS: PKR 61.72) in the same period last year (SPLY).

The company’s topline surged by 14% YoY to PKR 14.42 billion in 9MCY23, compared to PKR 12.60 billion in the corresponding period of the previous year. Gross Profit also experienced a substantial YoY increase of 14%, reaching PKR 6.92 billion in 9MCY23, up from PKR 6.06 billion in SPLY..

Cost of sales reached PKR 7.50 billion in 9MCY23, a notable increase of 15% YoY from PKR 6.54 billion in the corresponding period last year. Other income saw a significant rise of 67% YoY to PKR 313.60 million, compared to PKR 188.15 million in SPLY.

Distribution expenses and administrative expenses increased by 12% YoY and 33% YoY to PKR 4.17 billion and PKR 1.38 billion, respectively, while finance costs witnessed a 10% YoY increase to PKR 591.63 million in 9MCY23. Bata has no short-term and long-term loans on its books.

The Profit Before Tax (PBT) for 9MCY23 increased by 11% YoY to PKR 904.48 million, compared to PKR 816.30 million in SPLY. Profitability and margins were negatively impacted by supply chain issues, higher inflation, and costs in 9MCY23.

Bata’s retail network comprises more than 400 stores across Pakistan. Bata has opened 72 franchises, whereas the wholesale network consists of 13 distributors and 3,000 MBO’s. Bata’s production units at Batapur and Maraka have a total capacity of 18.38 million pairs, with

the current plant utilization standing at 63%. At the Maraka plant, a 1MW solar plant was installed, saving PKR 28 million in 9MCY23. Bata imports 40-50% of its raw material.

In 9MCY23, Bata registered a sales turnover of PKR 328 million, up 49% YoY in franchise business. Moreover, Bata automated the entire franchise business process. Twenty new franchises were opened during the period under review. The estimated cost of opening a store is around PKR 8-10 million.

Furthermore, the footwear company has opened ten new retail stores, facelifted 23 stores, renovated 14 stores, and opened sixty sneaker studios. Due to all these upgrades and expansions, Bata incurred total capital expenditures of PKR 335 million in 9MCY23.

The turnover from online business was reported at PKR 382 million in 9MCY23. Through Omni channels, Bata integrated 30 stores, fulfilling 20% of total orders. Daraz integration has also been created, reducing the cancellation rate by 1.8% and achieving a positive seller rating of greater than 90%. Additionally, Bata completed ISS testing in 1HCY23, integrating 334 stores with ISS. The YTD turnover stands at PKR 40 million in 9MCY23.

The management shared that the Company is focused on local business rather than exports because Bata is already operating in more than sixty countries. However, the informal sector in Pakistan is growing at a large scale to avoid heavy duties and taxes on footwear, increasing the spread between margins of the formal and informal sectors.

Furthermore, the Company has a strategy in place to meet the increasing competition in the footwear industry by introducing new shoe categories such as women’s wear and sneakers that are likely to be launched next year.

Regarding online business, the Company is selling the products at 25% lower prices than retail stores. However, the margins are still higher for online business. The focus of the Company is on low-price articles.

In CSR initiatives, BATA organized many school renovations, sports events, tree plantation drives, health awareness campaigns, shoe donations to less privileged children, and imparting IT skills education in CY23.

Going forward, the management anticipates higher profits in the upcoming year. Moreover, the Company plans to increase the number of sneaker stores.

Moreover, the expansion in Tier-III and Tier-IV areas and capitalize on revenue growth, a cash-led distribution model, and utilizing emerging channels on Omni and ISS are key areas of focus. The Company expects to generate an additional PKR 500-600 million from ISS stores next year.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.