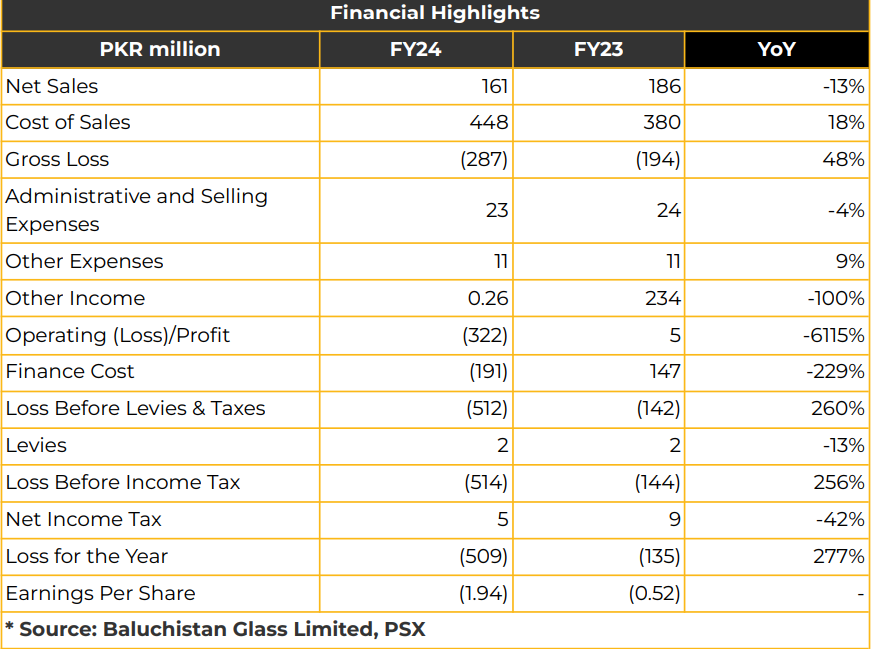

In FY24, Baluchistan Glass Limited (BGL) reported a net loss of PKR 508.72 million (LPS: PKR 1.94), significantly higher than the PKR 135.06 million (LPS: PKR 0.52) loss in FY23. The company’s net sales declined 13% YoY to PKR161.35 million, down from PKR 186.00 million in the previous year. The substantial loss was primarily due to the suspension of glass production in all three units, except Unit No. 1,which resumed operations in the last month of FY24. The shutdowns were driven by inconsistent gas supply, rising energy costs, and operational difficulties, leading to the closure of BGL’s production in May 2022.However, with support from Tariq Glass Industries Limited (TGL), which acquired a 42.17% stake in BGL inFY23, Unit-1 in Hub, Baluchistan, was rehabilitated and restarted in June FY24. This unit is now producing tableware, container ware, and pharmaceutical glass products at an efficiency level of 85%. The unit’s capacity increased to 110 tons/day post renovation, compared to the previous 70 tons/day. The gross loss increased to PKR 286.68 million, and the cost of sales surged 18% YoY to PKR 448.03 million, largely due to higher wages, utility expenses, and operational costs. The finance cost also grew 29% YoY to PKR 190.60 million, from PKR 147.49 million in FY23. The company’s retained earnings dropped to PKR 859.75 million, down from PKR 1.76 billion in the prior year. Management noted that comparative lower fuel costs

led to the resumption of Unit-1, which now produces 40% tableware and 60% container ware. The company has started producing pharmaceutical glass packaging and is currently in the testing phase with MNCs, while also delivering samples to local companies. Additionally, shareholders approved increasing the company’s paid-up capital from PKR 2.6 billion to PKR 6.38 billion by converting a loan of PKR 3.7 billion from MMM Holding into equity, subject to SECP approval and legal compliance. The company plans to revive operations in Units II and III after considering gas prices in Punjab. The company reported a current ratio of 0.35, a debt-to-equity ratio of 151%, an ROCE of (16.48%), and an ROE of (20.20%). The gross profit margin dropped to (177.68%), primarily due to higher inventory levels, lower sales, and increased power and fuel expenses. BGL receives only 30-40% of the sanctioned gas load available, priced at PKR 2,150 per MMBtu. Going forward, BGL plans to focus on improving the quality and profitability of its tableware segment while introducing alternate energy solutions to reduce operational costs. Management also aims to restructure the company’s financial obligations to improve liquidity and financial flexibility. The marketing strategy for pharmaceutical glass packaging will be revised to stimulate demand, and BGL seeks to grow its market share in this segment.

Important Disclosures Disclaimer:

This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.