Key Takeaways:

• The management categorically denied selling of Attock Cement plant.

• Management anticipates 10% decline in cement demand in the ongoing fiscal year.

• Management expects price to increase in the south region.

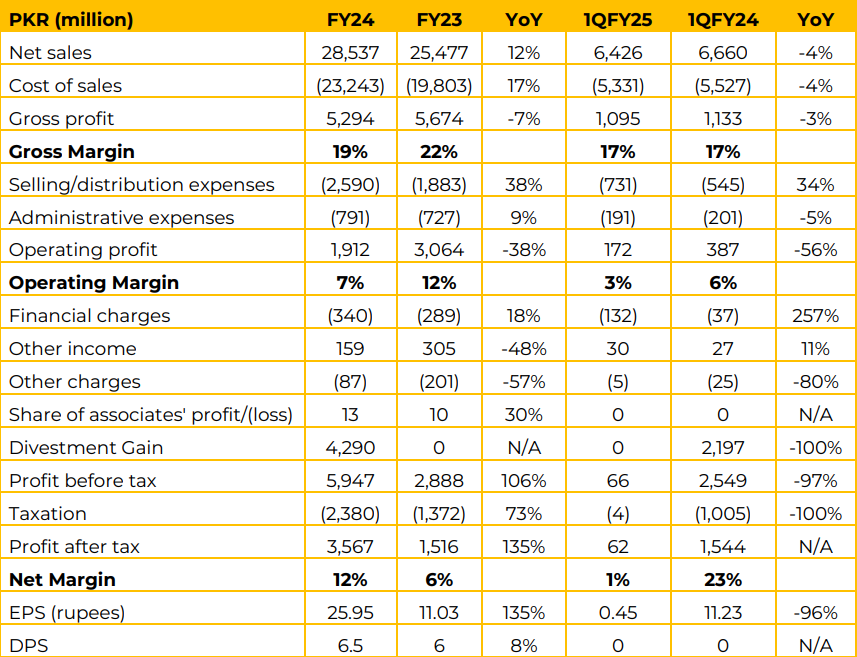

The company posted a 12% YoY growth in FY24 net sales, reaching PKR 28,537 million, driven by higher dispatches of clinker.

However, 1QFY25 sales decreased by 4% YoY, due to lower dispatches in the South region. Even though the prices in the international markets are not encouraging, however due to surplus capacities, the industry players from South kept exporting the surplus clinker / cement.

Local cement dispatches declined by 9% YoY to 1,239,154 tons. Export cement dispatches fell sharply by 17% YoY to 125,352 tons. Export clinker dispatches surged by 77% YoY to 970,213 tons, compensating for lower cement exports and pointing to stronger demand for clinker in export markets. Total dispatches (local + export) grew by 14% YoY to 2,334,719 tons, mainly supported by the strong performance in export markets, particularly clinker.

Gross profit declined by 7% YoY to PKR 5,294 million in FY24, with gross margins compressing to 19% from 22% in FY23, due to high volume but low retention in export sale. In 1QFY25, gross profit fell slightly by 3% YoY to PKR 1,095 million, while the gross margin remained stable at 17%, consistent with 1QFY24.

Operating profit declined significantly by 38% YoY to PKR 1,912 million, driven by a sharp 38% increase in selling and distribution expenses. For 1QFY25, the operating profit fell sharply by 56% YoY to PKR 172 million due to a 34% increase in selling expenses. This is mainly due to extra operations required for export sales.

In FY24, the company divested its plant based in Iraq, yielding a gain of PKR 4.28 billion. This gain represents exchange difference, non-competing fee and consideration for loss of majority control. The proceeds from this divestment were utilized for the establishment of Line-4 (Capacity: 1,275,000 tons per annum) and 4.8 MW in HubBaluchistan.

This wind mill will become operational in first quarter of calendar year 2025 and will help reducing the power cost. . In export sales, the price of clinker is $30-32 per ton, while cement is $38-40 per ton. Local MRP of cement is Rs. 1,350 per bag (PKR 27,000 per ton).

The management also highlights a pricing discrepancy between the North and South regions, where prices in the South, which have traditionally been higher, have recently fallen. The management believes that prices in the South should be increased going forward to bring them in line with market conditions. Going forward, with expectations of easing interest rates and lower inflation, domestic demand may improve in the upcoming months.

However, the export market remains challenging with low prices, and efforts are being made to secure orders that contribute positively to margins. On the cost front, the company will continue its cost reduction initiatives, including the induction of a 4.8 MW windmill and increased use of alternative, cheaper fuels, which will help lower production costs and mitigate some of the external pressures the company faces.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.