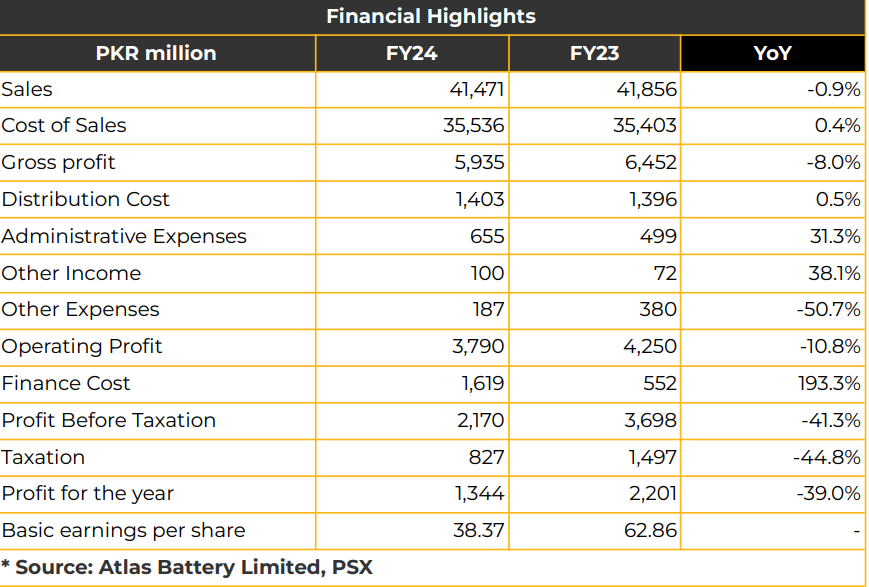

In FY24, Atlas Battery Limited reported a net profit of PKR 1.34 billion (EPS: PKR 34.38), reflecting a 39% YoY decline compared to PKR 2.20 billion (EPS: PKR 62.86) in FY23. Net sales remained largely unchanged at PKR 41.47 billion, slightly down from PKR 41.86 billion in the previous year. Gross profit decreased by 8% YoY to PKR 5.93 billion, compared to PKR 6.45 billion in the SPLY, while operating profit contracted by 11% YoY to PKR 3.79 billion from PKR 4.25 billion in FY23. Despite a topline drop, gross profit margins improved, standing at 14% YoY versus 8% in the SPLY. EBITDA margins were reported at 10.5% in FY24 (FY23: 11.3%). Return on assets dropped to 5.8%, down from 11.1%, while return on capital employed stood at 37.7%, compared to 47.8% during the period. The finance cost surged to PKR 1.62 billion in FY24 from PKR 552.07 million in the SPLY, attributed to higher working capital requirements and elevated markup rates. Management revealed that the introduction of lithium batteries is still in the study phase, with no widespread adoption expected in the next 2-3 years due to higher costs. The total battery market size shrank to 10 million units from 11 million last year, with ATBA holding a 24% market share in the batteries segment and a 35-40% share in energy storage batteries. The cost structure of a battery includes 65-70% LED-related costs. Total assets and liabilities were both reported at PKR 23.32 billion, reflecting a 17% YoY increase from PKR 19.91 billion in the SPLY. Asset turnover, inventory turnover, and trade debt turnover were recorded at 1.9x (FY23: 2.7x), 3.1x (FY23: 4.5x), and 152x (FY23: 25.8x), respectively, in FY24. Inventory holding days increased to 119 days (FY23: 80 days), the trade debt collection period rose to 24 days (FY23: 14 days), and the operating cycle lengthened to 95 days (FY23: 50 days). The current, quick, and financial leverage ratios remained steady at 1.4x, 0.4x, and 1.2x (FY23: 1.4x, 0.4x, 0.8x), respectively. The interest coverage ratio dropped significantly to 2.3x from 7.7x in the SPLY. ATBA plans to focus on product innovation, waste reduction, and efficient procurement to lower the

break-even point, while also implementing environmentally compliant plants to create barriers to entry. Over the past two years, ATBA introduced three new automotive batteries and one motorcycle battery. Management noted that 23-24% of batteries sold were for replacements, as higher car prices deterred new purchases. Inflation further impacted consumer purchasing power. ATBA received positive feedback on both lead-acid and MS batteries due to good conversion to MS batteries. Going forward, management anticipates margin pressure due to the limited material impact of reduced inflation, coupled with higher utility prices and increased use of LPG during winter. The company also plans to explore new export destinations to diversify its market.

Important Disclosures

Disclaimer:

This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for

information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or

solicitation or any offer to buy. While reasonable care has been taken to ensure that the information

contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes

no representation as to its accuracy or completeness and it should not be relied upon as such. From time

to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a

position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this

report Chase Securities as a firm may have business relationships, including investment banking

relationships with the companies referred to in this report This report is provided only for the information

of professional advisers who are expected to make their own investment decisions without undue reliance

on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect

consequential loss arising from any use of this report or its contents At the same time, it should be noted

that investments in capital markets are also subject to market risks This report may not be reproduced,

distributed or published by any recipient for any purpose.