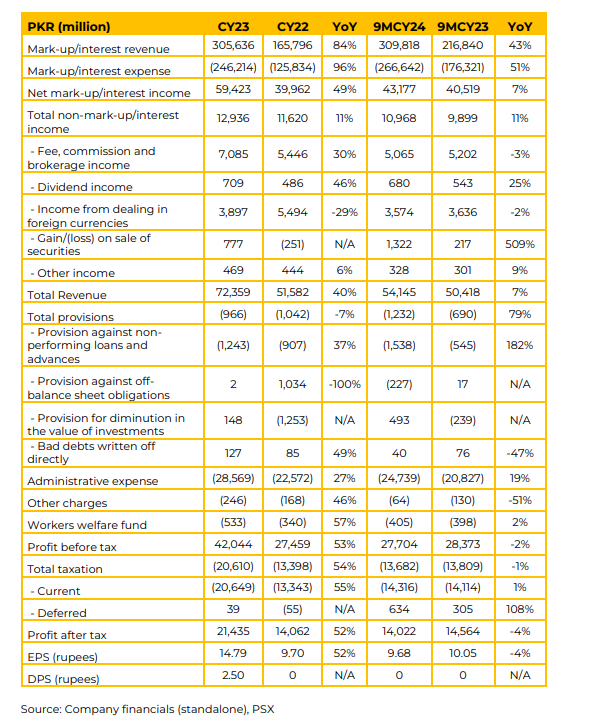

Askari Bank’s net markup income increased by 7% YoY in 9MCY24, reaching PKR 43,177 million. This growth was primarily driven by volumetric expansion and a 29% increase in earning assets.

Non-markup income also rose by 11% YoY during the 9M period, supported by gains on securities. The Bank’s strategy of expanding its branch network and investing in technology, coupled with the impact of inflation, led to an 18% YoY increase in operating expenses in 9MCY24.

Consequently, the cost-to-income ratio stood at 46.6% in 9MCY24. Profit before tax (PBT) declined by 2% YoY in 9MCY24, largely due to higher provisions against non-performing loans. The earnings per share (EPS) for the period stood at PKR 9.68, compared to PKR 10.50 in 9MCY23.

Customer deposits grew by 10% during the period, closing at PKR 1.4 trillion as of September 30, 2024. CASA deposits represented 88% of the total (27% current accounts and 61% savings accounts), reflecting an improvement from 84% in the prior period.

Advances declined by 24% YoY, primarily due to net retirement of short-term seasonal financing during the quarter. The current advances-to-deposit ratio (ADR) stands at 52%. Investments increased by 44% YoY, with the fixed-income portfolio reduced to 10% of the total. Meanwhile, PIB floaters and MTBs now constitute 84% of the investment book.

The branch network is projected to reach 720 by year-end, with 60 new branches added in 2024. However, branch growth is expected to slow in the coming years to optimize costs. Going forward, management anticipates a reduction in policy rates to single digits by CY25.

The current repo spread stands at 250+ basis points. AKBL is actively working on an Islamic banking conversion plan, with capacity building and product mapping already underway. Askari Currency Exchange Company, a subsidiary of AKBL, is operational with 11 outlets and plans to expand to 50 locations by the end of 2025.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.