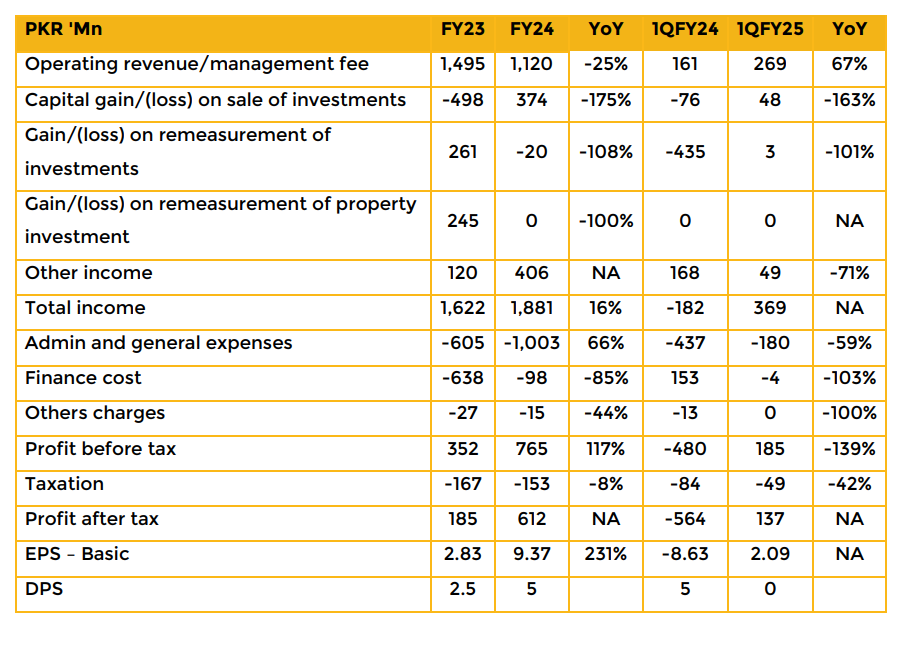

The company’s earnings per share increased by 231% to PKR 9.37 in FY24, compared to PKR 2.83 in FY23. In 1QFY25, the company reported earnings per share of PKR 2.09, compared to a loss per share of PKR 8.63 in 1QFY24.

The company currently holds a 8-10% market share in the brokerage business, with new account openings aligning with their market share.

In the Roshan Digital Account segment, they maintain a 27.4% market share, representing a total of 3,584 accounts. The company has also recently introduced a new trading app, which features an enhanced user interface.

The company is focusing on attracting new customers through enhanced marketing and awareness strategies. In the treasury brokerage business, the company has been growing at a 5-year CAGR of 30% and expects this growth trajectory to continue at a similar pace.

Management anticipates stable earnings growth ahead driven by increased trading volumes due to rapid index movements. By CY25, the management projects conducting 5-6 IPOs and expects investment banking revenue growth to align with these IPO activities.

The management expects lesser investment banking activity in the debt market due to lower interest rates.

The management also indicated plans to distribute 50-55% of earnings as dividends. Furthermore, they are willing to increase their book size through retained earnings, although this decision ultimately rests with the sponsors.

Through an increase in book size, the management aims to enhance the proportion of MTS and MFS trades. This year, the company expects higher inflows in to equities from fixed-income instruments.

However, they noted that there is minimal foreign holding left to be sold off in the market.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.