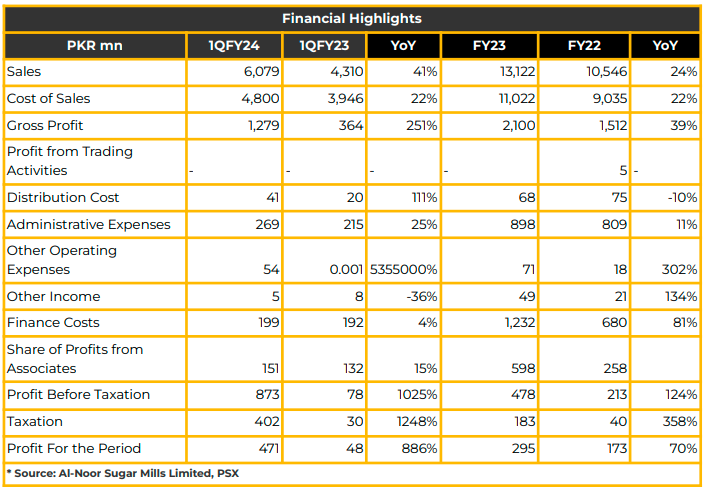

In 1QCY24, Al-Noor Sugar Mills Limited recorded a net profit of PKR 470.90 million (EPS: PKR 23.00), marking a substantial improvement compared to the PKR 47.76 million net profit (EPS: PKR 2.33) in the corresponding period of the previous year.

The company’s revenue for the CY23 reached PKR 13.12 billion, demonstrating a significant 24% year-on-year growth from the PKR 10.55 billion reported in the same period the previous year. Throughout FY23, gross profit experienced a 39% year-on-year increase to PKR 2.10

billion, while the cost of sales rose by 22% year-on-year to PKR 9.03 billion, driven by elevated raw material costs.

The gross profit margin and EBITDA margins for FY23 were reported at 16% (compared to 14.33% in FY22) and 15.64% (compared to 9.14% in FY22), respectively, reflecting an improvement from the previous year.

Management attributed this enhancement to the favorable impact of currency devaluation. The return on equity (ROE) was recorded at 3.84% (compared to 5% in FY22) during the same period.

The current ratio and debt-to-equity ratio stood at 0.93 (compared to 1.07 in FY22) and 2.80 (compared to 1.13 in FY22). ALNRS’s equity was reported at PKR 7.68 billion, with debt at PKR 2.75 billion.

Distribution expenses decreased by 10% year-on-year to PKR 67.53 million, while administrative expenses increased by 11% year-on-year to PKR 898.41 million during the same period. Finance costs rose to PKR 1.23 billion in FY23, attributed to higher interest rates compared to PKR 680.02 million in FY22.

In the Sugar Division, crushing production was recorded at 789,713 MT, which was lower than the previous year, while sugar production was reported at 79,575 MT. In the MDF Board Division, Mande Line and Sunds Line production were recorded at 24,359 cubic meters and 41,869 cubic meters, respectively, in line with the production in FY22.

The sugarcane price was disclosed at PKR 440, and the company anticipates this price to increase to PKR 452 going forward. The company management informed that the company is producing sugar at a break-even price of PKR 137.

Looking ahead, the management anticipates an improvement in production. Moreover, they expect the recovery ratio to increase to 10.5 at the end of this season from 10.09 in FY23.

Important Disclosures

Disclaimer:

This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.