Key Takeaways:

• Management expects sales volume to remain 210K tons in FY25 (FY24: 165K tons); 27% YoY growth.

• Gross margins expected to improve to industry average of 10-11%.

• Finance cost expected to decline, targeting a potential profit.

• HRC prices to remain stable; above $500 per ton.

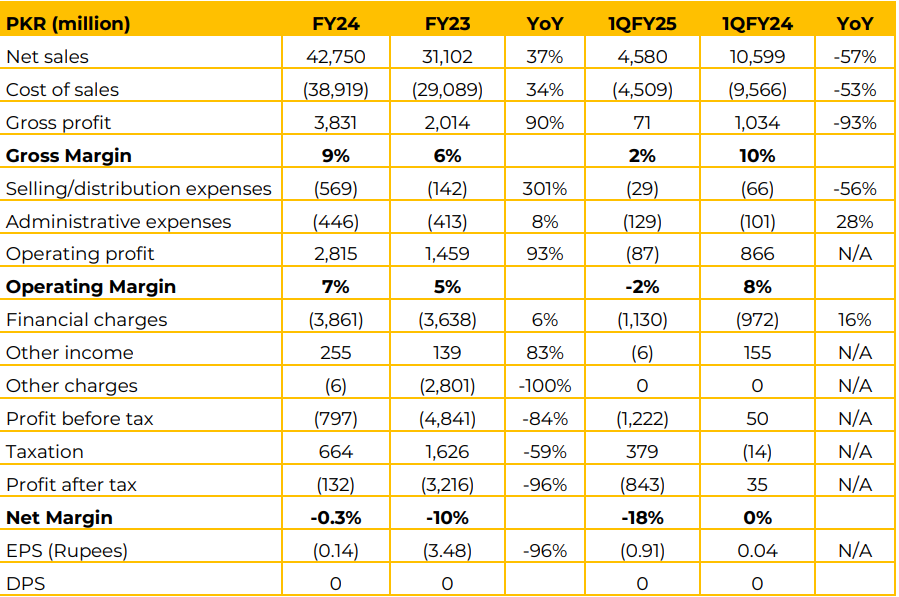

Aisha Steel Mills experienced a notable 37% YoY increase in net sales, which rose to PKR 42,750 million in FY24. However, in 1QFY25, net sales saw 57% decline to PKR 4,580 million, down from PKR 10,599 million in 1QFY24.

This decline is attributed to the increased competition by the FATA/PATA importers, enjoying sales tax exemptions, avoiding the antidumping duties through importing under other nomenclatures.

Gross profit surged by 90% YoY, reaching PKR 3,831 million in FY24. The gross margin also rose from 6% to 9%. However, in 1QFY25, gross profit saw a sharp decline of 93%, from PKR 1,034 million in 1QFY24 to only PKR 71 million.

The gross margin also contracted to 2% from 10% in the prior year’s quarter, as the company had to be price competitive against the FATA/PATA importers.

The management highlighted that the market share of imported material against the local producers have risen to 52%. Due to added advantage of sales tax exemption, if company reduces prices by Rs. 40,000 – 45,000 per ton, the importers match it by discounting up to Rs. 50,000 per ton.

However, FBR has now directed the importers to deposit pay order as against post-dated cheque, locking the working capital of importers, thereby reducing the magnitude of imports.

The sales volume of 1QFY25 stood at 23,000 tons. The management expects average sales volume for 2QFY25 and FY25 to remain 45,000 tons and 210,000 tons (FY24: 164,732 tons) respectively inclusive of the export sales. The management also expects its export to America to increase.

Moreover, they highlighted that the gross margin for the steel industry has remained in a range of 10-11% historically and expects that ASL’s margins will also normalize to the same level.

However, the biggest challenge for the company is finance cost. Financial charges witnessed an increase of 6% YoY, reaching PKR 3,861 million in FY24, compared to PKR 3,638 million in FY23. In the first quarter of FY25, financial charges grew by 16%, reaching PKR 1,130 million compared to PKR 972 million in 1QFY24.

However, the situation is gradually improving with the decline in interest rates, and the management expects the finance cost to reduce and targets a positive bottom-line going forward.

Looking forward, the management expects recovery in sales volume, in-line with the declining interest rates and recovery in the overall demand of the country. The local producers have also requested National Tariff Commission to take concrete measures against the anti-duty circumvention to discourage high volume imports by the FATA/PATA region.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.