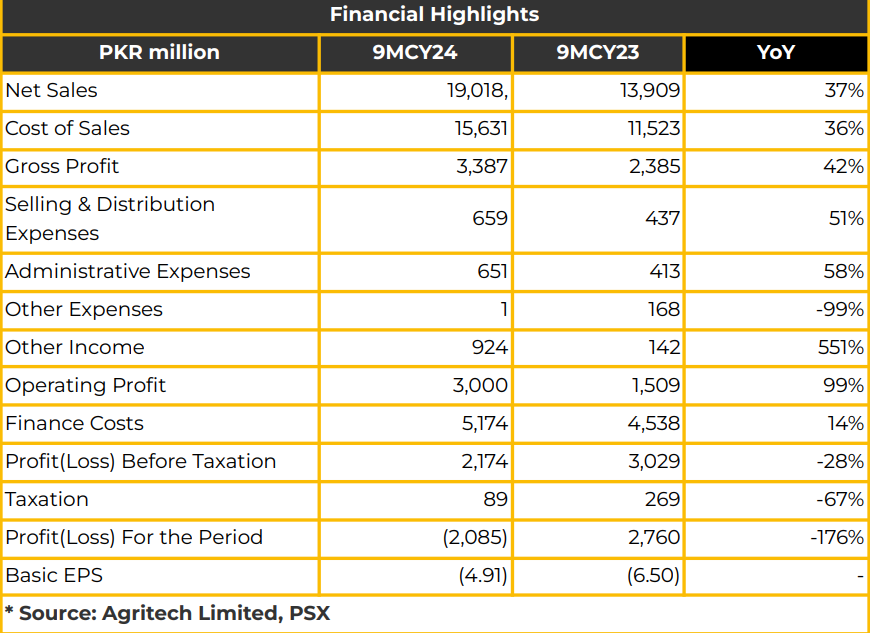

In 9MCY24, Agritech Limited reported a net loss of PKR 2.08 billion (LPS: PKR 4.91), an improvement from the previous year’s net loss of PKR 2.76 billion (LPS: PKR 6.50).

Agritech’s overall revenue increased by 37% YoY, reaching PKR 19.02 billion in 9MCY24, compared to PKR 13.91 billion in the SPLY. This growth was mainly attributed to consistent gas supply and the passing on of gas price increases. The gross profit rose by 42% YoY to PKR 3.39 billion, up from PKR 2.39 billion in the SPLY.

Operating profit also doubled, reaching PKR 3 billion in 9MCY24, compared to PKR 1.51 billion in the SPLY. Urea production across the industry increased by 3.7% to 4.9MT, driven by consistent gas supply. Two plants operate on the SNGPL gas network, while the other plant is connected to the SSGC network.

However, industry-wide urea offtake declined by 7.5% to 4.6MT due to poor farm economics in wheat production and declining maize and rice prices. The import of 220KT of urea also impacted offtake levels. International DAP prices stood at $650/ton. In the phosphate sector, production increased by 37% YoY to 445KT, despite fluctuations in international DAP prices.

However, phosphate offtake fell by 14% YoY to 556KT due to poor farm economics impacting farmers’ liquidity. Agritech’s market share in urea was reported at 6%, based on an industry capacity of 6.8MT, contingent on gas supply. In the SSP market, Agritech captured a 90% share, up from 70% in the SPLY.

Management reported that the implementation of the Scheme of Arrangement will streamline AGL’s debt structure. They expect to induct preference shares, TFCs, and Sukuks by the end of the year. Additionally, the company is actively settling short-term debts to improve its debt profile.

The gas tariff averaged PKR 1,597/mmbtu, and plants remained operational throughout the year. Agritech was allocated a gas volume of 29 mmscfd, supported by surplus RLNG, which management noted is favorable for plant utilization. Management reported that gas availability this year exceeded last year’s due to surplus RLNG, benefiting Agritech’s operations.

Agritech’s plants are located near OGDC, MPCL, and MARI facilities. Agritech received acquisition offers from FFC and MPCL. Maple Leaf’s offer is valid until mid-January, while FFC’s offer expires in mid-December. Going forward, the company plans to allocate additional CAPEX toward energy efficiency in urea plants in CY25.

Agritech also intends to expand SSP production by increasing granulation capacity and adding a new Sulphuric Acid plant. Management expects to benefit from tax relief on accumulated losses, with deferred tax assets totaling PKR 6.6 billion. These benefits will materialize once the company reports taxable profits. Management anticipates a continuous gas supply in the upcoming year, which should support improved production and offtake in the next quarter.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject to this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.