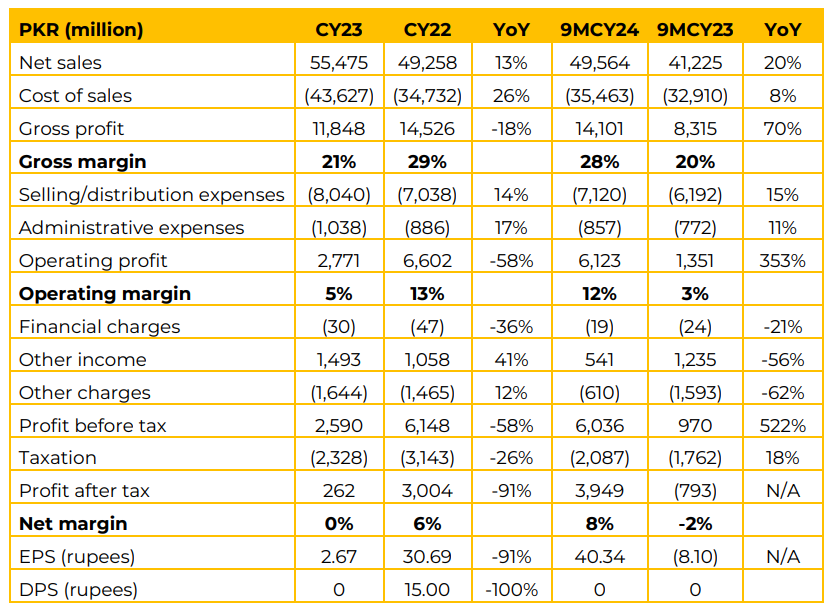

Abbott Pakistan’s net sales increased by 13% YoY in CY23 to PKR 55.5 billion compared to PKR 49.3 billion in CY22. The growth was more pronounced in the 9MCY24 period, where net sales rose by 20% YoY, reaching PKR 49.6 billion against PKR 41.2 billion in 9MCY23. In CY23, the pharmaceutical segment led with 20% growth to PKR 37.8 billion, while Nutritional declined 8% to PKR 11.4 billion.

Diagnostics increased 16% to PKR 4.8 billion, and Others rose 18% to PKR 1.5 billion. In CY23, gross margins shrank to 21% from 29% in CY22, mainly due to revision of product cost, rupee devaluation and general inflation.

However, in 9MCY24, the gross margin improved to 28%, driven by price adjustment and various other efficiency measure taken across the operations. Earnings per share (EPS) dropped significantly to PKR 2.67 in CY23 from PKR 30.69 in CY22, mainly on account of increase in product cost and rupee devaluation.

Additionally, no dividend per share (DPS) was announced in CY23 compared to PKR 15.00 in the previous year. For 9MCY24, EPS showed recovery, standing at PKR 40.34 compared to a negative EPS of PKR 8.10 in 9MCY23. The Government of Pakistan approved the deregulation of drug prices for products outside the National Essential Medicine List (NEML). This allowed the industry, including Abbott, to increase prices on its non-essential portfolio, restoring viability for products previously discontinued due to adverse margins.

However, the decision has been challenged in the Lahore High Court. Abbott reiterated its commitment to responsible pricing practices, ensuring patient interests remain a priority as it navigates this development. The company continues to revive discontinued products as they become viable due to deregulation. However, the challenge remains in the essential items, where the industry is only allowed to increase the price up to 70% of CPI with a cap of 7%.

The viability of such products is also dependent upon the rupee stability and inflation. Company’s sales to institution customers is 7-8% of the total sales, while 5-6% of the total sales is exported to countries like Afghanistan, Bangladesh and Sri Lanka. Going forward, the management remains hopeful to see volumetric growth in CY25.

The company is also working to introduce biosimilars, details of which are not disclosed yet. The company is targeting to acquire more customers in the diagnostics segment and margins remains healthy. The management does not see Centrum by Haleon as direct competition to its products like Surbex-Z. According to the management, the industry-wide and company’s mix of essential & non-essential medicines remains close to 50%-50%.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.