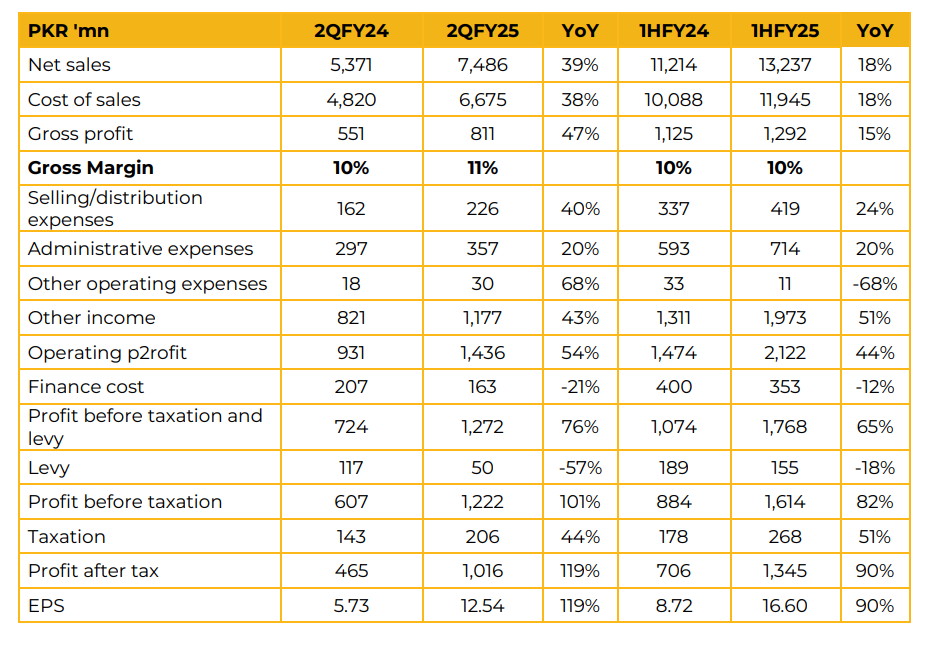

THALL reported a net profit of PKR 1.35 billion (EPS: PKR 16.60) in 1HFY25, reflecting a 119% increase from PKR 706.36 million (EPS: PKR 8.72) in the previous year.

Management highlighted ongoing expansion in the Engineering division through new technical partnerships in Korea and Japan. The aftermarket dealership network increased to 19 dealers from 12 last year. and refrigerators.

In 1HFY25, the company secured orders for new variants and upcoming Hyundai models. The Jute Division reported sales of 6,801MT in 1HFY25 (1HFY24: 5,578MT), with Hessian contributing 44%, Sacking 47%, and others 9%. THALL holds a 16% market share of total PJMA production, with a dominant 76% share in the export market.

The resumption of exports to Sudan supported sales growth, while reduced wheat procurement by the government led to lower domestic sales. Rising polypropylene demand, driven by cost advantages, has pushed operations to full capacity despite jute price pressures. Export sales grew by 5% to PKR 1.73 billion in 2QFY25, compared to PKR 1.64 billion in the same period last year. IKEA has registered Thal as Pakistan’s first non-textile supplier and integrated it into its global matrix for FRAKTA bags.

The Laminates Division delivered a strong turnaround, driven by improving economic conditions and an expanding regional presence through strategic sales hubs. Global reach has extended to the GCC and West Africa, with increased raw material localization, including Kraft paper, décor paper, and in-house ink & printing.

Company expects duty-free imports under EFS. Solar energy capacity has been reported as follows: 3.5MW for Jute, 1.7MW for Packaging, 0.4MW for Laminates, and 0.6MW for Engineering, bringing the total to 6.2MW. Diversification efforts include developing transformer oil level sensor for power sector. The company introduced white goods with the commencement of wire harness supplies for air conditioners.

Management expects power costs to decline to PKR 12.5/Kwh following the completion of Phase III of Thar coal under SECMC, with tariffs decreasing further in subsequent phases. Phase IV is now underway, with Phase III being funded through internal cash. ThalNova Power Plant produced 902GWh at a 68% load factor for the period ended December 31, 2024. Phase II PCD of SECMC has been announced, while ThalNova PCD is in progress.

Receivables from IPPs are at 100% this year. Regarding shariah compliance, management stated that the company remains underleveraged, eliminating any concerns. The company has received 100 transformers from KE, with an additional order in progress. KE plans to procure 50,000 sensors over the next 2-3 years, with the next 1,000-unit order expected in 2025, valued at several million.

The total demand for existing transformers stands at 500,000 sensors. Wire harnesses contribute 50% of Thal Engineering’s revenue, with the remaining 50% from thermal components. In the commercial segment, wire harnesses are used only in Hino buses, accounting for 3-5% of total revenue, while passenger cars remain the primary revenue driver. Management expects dividends from SECMC in the coming years and anticipates stronger 2HFY25 results.

Automobile sales are expected to improve following interest rate reductions and the introduction of new variants. The Jute Division is working on jute, cotton, and banana-based products, along with new developments across all auto segments. The ThalNova dividend is expected after PCD completion. The government’s construction package is in its final stages, and the company is expanding exports in the Laminates business.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.