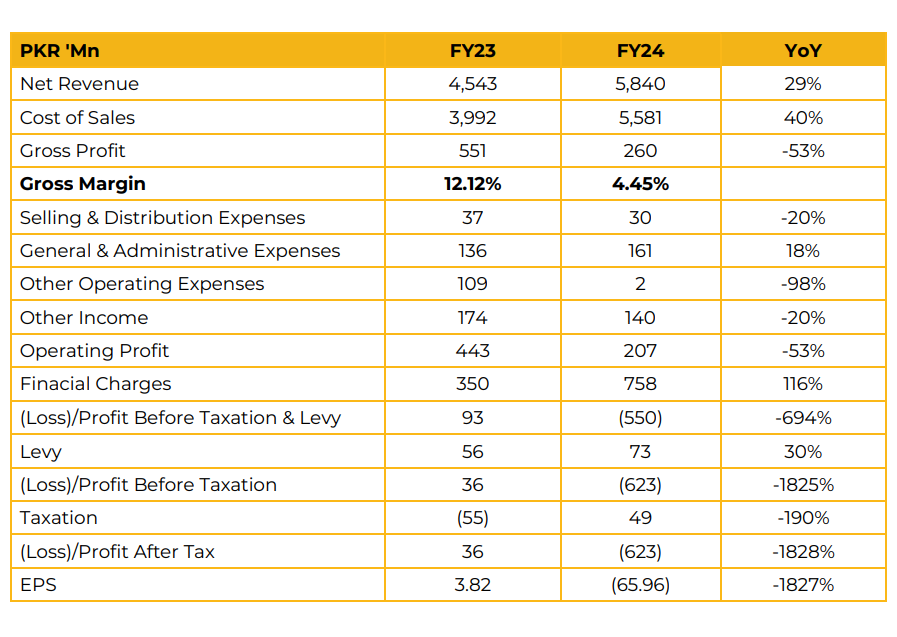

In FY24, Baba Farid Sugar Mills Limited (BAFS) reported a net loss of PKR 623.37 million (LPS: PKR 65.96), compared to a net profit of PKR 36.08 million (EPS: PKR 3.82) in FY23. The decline was primarily due to higher financial costs and rising sugarcane prices. BAFS crushed 1.06 million metric tons of sugarcane in FY24, producing 0.52 million metric tons of sugar with a recovery rate of 10.07%. Despite a crushing capacity of 10,000 tons per day, BAFS operated at only 6,000 tons due to bottlenecks. The company plans to address these inefficiencies through investments, though it currently faces economic challenges. The revenue mix for FY24 was as follows: sugar contributed 88.84%, molasses 10.20%, bagasse 0.55%, and press mud 0.41%.

BAFS procured sugarcane worth approximately PKR 4 billion at an average price of PKR 410 per maund this crushing season. Prices are expected to settle around PKR 420-430 per maund, compared to an average of PKR 460 in FY24. International molasses prices surged to nearly $1,000 per ton in FY24 due to rupee depreciation, reaching PKR 37,000- 38,000 per ton. However, with the rupee stabilizing and increased ethanol production from corn molasses in Brazil, molasses prices have now declined to PKR 26,000-27,000 per ton. Total assets increased to PKR 6.2 billion in FY24.

The net debt-to-equity ratio stood at 1.40, while the current ratio was reported at 0.85. The company’s major investment plans are primarily being financed through debt and interest-free loans from directors. Going forward, with yields expected to drop 10-15%, sugar production is likely to decline by 5-10%, reaching around 6.2- 6.3 million tons. With an estimated stock of 7 million tons, no major sugar shortage is anticipated, and the surplus will remain minimal. The final production figure will depend on the remaining one-third of the crushing season. Given current market conditions, sugar prices are expected to remain stable around PKR 140/kg

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose