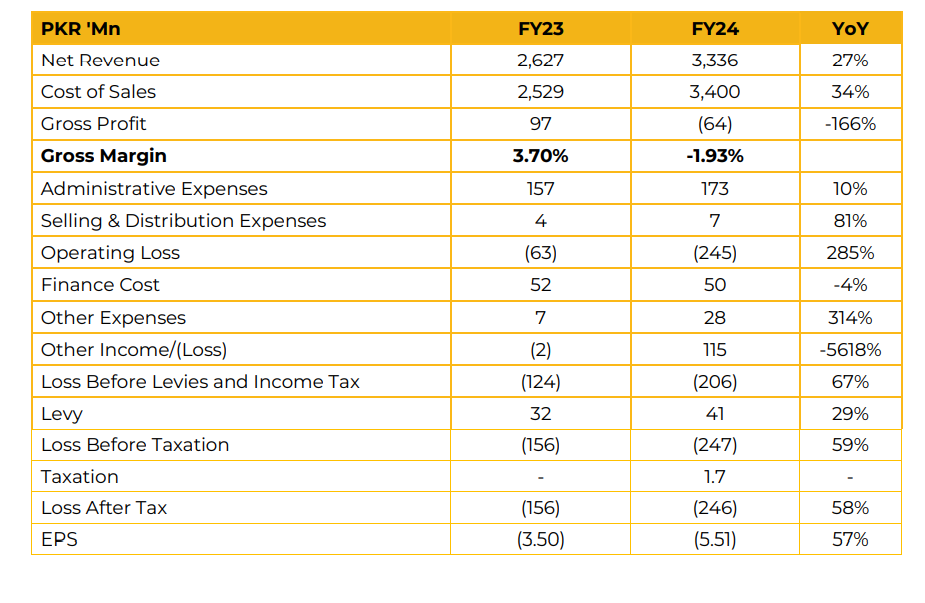

In FY24, Sakrand Sugar Mills Limited (SKRS) reported a net loss of PKR 245.99 million (LPS: PKR 5.51), compared to a net loss of PKR 156.07 million (LPS: PKR 3.50) in the previous year. The increase in losses was primarily due to rising production costs outpacing selling prices, driven by the Government of Sindh’s decision to raise the minimum sugarcane price to PKR 425 per 40 kg, an increase of PKR 123 from the prior season. The company crushed 257,489 metric tons of sugarcane in FY24, up slightly from 252,153 metric tons in FY23. Sugar production reached 26,205 metric tons (FY23: 25,716 metric tons), with a recovery rate of 10.20%.

Molasses production rose to 13,580 metric tons (FY23: 12,330 metric tons) with a recovery rate of 5.28%. Despite the longer duration of crushing season of 98 days, the total crushing volume remained relatively stable as the company focused on procuring higher-quality sugarcane varieties to reduce production losses. In FY24, the product-wise sales mix showed sugar contributing 87.52% of total revenue, molasses 12.28%, fertilizer 0.15%, and mud 0.06%. Production costs surged by 50% during the year, with the average sugarcane cost rising to PKR 113,232 per metric ton, while sugarcane revenue increased by 37% YoY to PKR 109,121 per metric ton.

The main driver of the cost increase was the higher sugarcane support price. During FY25, SKRS negotiated and settled its long-term outstanding debt with the National Bank of Pakistan, improving its financial stability. The principal amount of PKR 15 million and markup of PKR 7 million are scheduled to be fully settled by June 2025, with the first payment already made in January 2025. Going forward, management expects growth in fertilizer production and sales, which began in FY24, to offset some of the losses incurred in the sugar segment, supporting overall profitability.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.