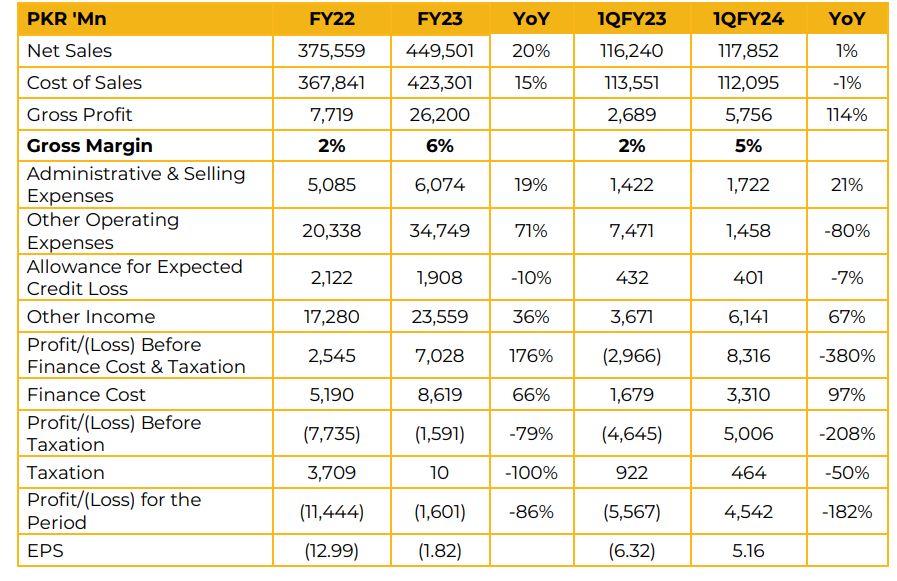

SSGC reported a net profit of PKR 4.54 billion (EPS: PKR 5.16) in 1QFY24, a substantial turnaround from a net loss of PKR 5.57 billion (LPS: PKR 6.32) in 1QFY23.

Revenue for 1QFY24 increased by 1% year-on-year to PKR 117.85 billion, primarily due to price adjustments. Gross profit rose significantly to PKR 5.76 billion in 1QFY24, compared to PKR 2.69 billion in the same period last year.

The sales mix for 1QFY24 included domestic at 44.3%, captive power at 22.5%, process industries at 20.3%, fertilizer at 7.1%, power at 3%, commercial at 2.3%, steel at 0.4%, and CNG at 0.1%. Management reported that the annual gas supply has declined to 266 BCF, which meets one-third of the country’s demand. UFG was reported at 10.14% in FY23, and efforts are underway to bring it down to single digits in coming years.

Management attributed the improvement in SNGPL’s credit rating to enhanced operational efficiencies, reduced UFG losses, extensive rehabilitation programs, and diversification into non-operating income streams. SSGC LPG Limited achieved record LPG sales of 98,700 MT in FY23. Its profit increased from PKR 0.769 billion in FY23 to PKR 1.2 billion in FY24, and its market share rose to 7.7%.

Management expects higher demand for LPG and plans to meet it by transporting LPG through pipelines. Management reported that natural gas price hikes in November 2023, February 2024, and July 2024, improved the ability of Sui Companies to settle dues with E&P firms.

Gas supply to PSML was discontinued on June 30, 2024. GRAappointed consultant’s report on pre-June 2020 interenterprise liabilities is still pending. Management reported the rehabilitation of approximately 200 km of pipelines from FY13 to FY22. In FY23, this increased to 742 km, with targets set at 1,500 km for FY24 and 2,500 km annually from FY25 to FY27. After Karachi, management aims to expand rehabilitation efforts to other areas of Sindh and adjacent regions. The SSGC manufacturing plant has a capacity of 2.5 million meters and significant potential for exports in collaboration with SNGPL.

The company plans to export high-standard meters to Central Asia and Europe after obtaining necessary certifications. Management intends to establish this as a separate public company, independent of SSGC’s operations. SSGC Alternate Energy has completed restructuring and will operate as a private company.

Management confirmed the 100% localization of larger meters in collaboration with a French company and plans to introduce automatic meter reading modules. The company is also working with E&P firms to secure higher prices for purified gas.

Management reported progress in promoting biomethane and biogas, with SSGC AE as a confirmed buyer. Two MoUs have been signed with companies operating in Thar, planning supply of gas through pipelines from Thar to consumption areas if production commences. Going forward, SSGC plans pay a dividend, subject to board decision. SSGC aims to achieve a rate of return of 22.50% and 22.05% in FY25 and FY26 and actual UFG at 10.50%.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.