Key Takeaways:

• Changed their crude mix and increase the production of HSD

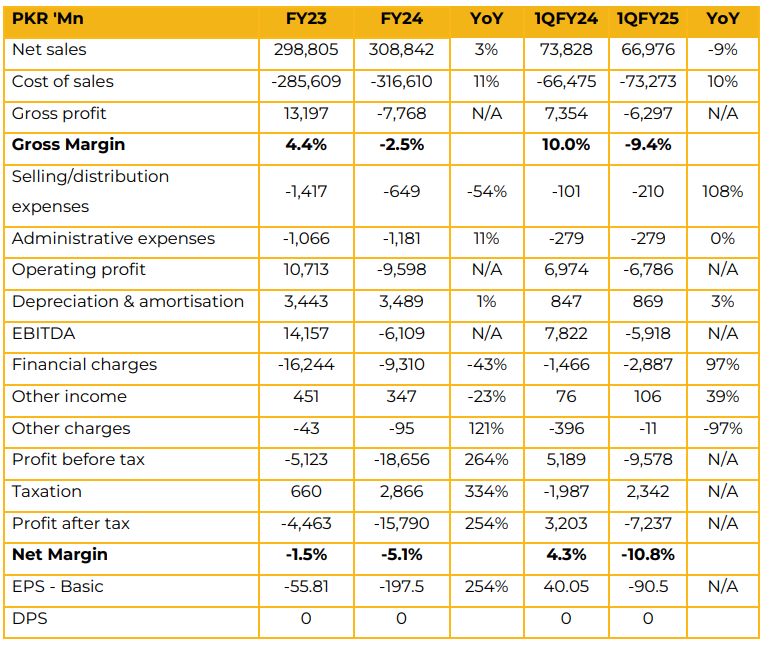

National Refinery Limited reported loss per share of PKR 197.5 in FY24 against a loss per share of PKR 55.81 in FY23. Furthermore, in 1QFY25 the company reported loss per share of PKR 90.5 against earnings per share of PKR 40.05 in SPLY. The company’s crude oil refining capacity is 70,000 barrels per day.

There was a drop in product prices, especially in the 2nd and 4th quarters, which led to inventory losses. Margins and premiums for HSD and motor gasoline declined sharply over the last three quarters. The company faced inventory losses amounting to 7.4 billion on a month-on-month basis. Globally, there was a decline in lube margins. Although earlier there were good margins, the turnaround also impacted the volumes.

They added that with reduced infrastructure development, they are forced to export bitumen at significant losses. They were also unable to sell volumes due to smuggling, an issue they highlighted to the government and SIFC. Their conversion costs were high due to operating at a low throughput of 52%.

The company-wide gross margins for FY23-24 stood at $2.93 per barrel, compared to $10.17 in the same period last year. Lube margins were $10.44 for FY23-24 as compared to $20.55 in the corresponding period last year.

During the year, they faced high LC charges due to the country’s credit rating and lower foreign exchange reserves. HSD margins dropped to 31% in FY24 compared to 48% in the same period last year.

The company changed its crude mix, increasing HSD production and rationalizing loss-making furnace oil and bitumen.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.