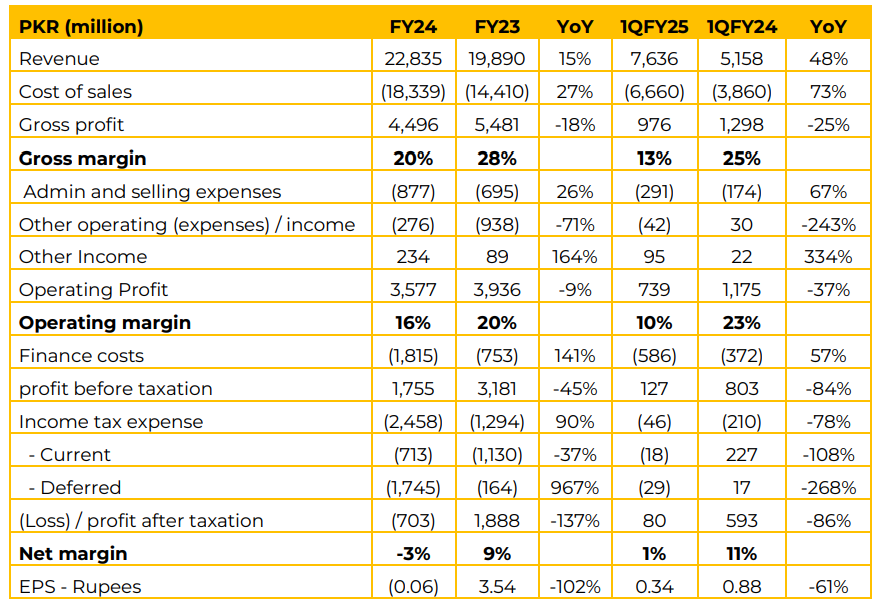

IPAK posted a 15% YoY increase in revenue for FY24, reaching PKR 22,835 million. The sales growth was driven by 11.7% volume growth. The average price was lower due to sales mix and higher export compared to the last year. This growth was further accentuated in 1QFY25, where revenue surged by 48% YoY to PKR 7,636 million.

Company’s gross margin fell from 28% in FY23 to 20% in FY24. The trend was even more pronounced in 1QFY25, where the gross margin declined to 13% from 25% in 1QFY24. The company highlighted its strategic focus on expanding its export portfolio to strengthen market presence.

The lower margins on export sales compared to domestic sales have contributed to a decline in overall gross margins during the period. The company reported a net loss of PKR 703 million in FY24 compared to a profit of PKR 1,888 million in FY23, mainly due to high deferred tax expense arising from the capitalization of new plants.

IPAK has a total nameplate capacity of 152,660 tons per annum and an operational capacity of 113,000 tons. The BOPP segment leads with GPAK delivering 40,000 tons annually. CPP and BOPET films provide 8,000 and 35,000 tons, respectively. Additionally, specialized metalized films have a capacity of 26,400 tons, reflecting IPAK’s diverse production capabilities.

In order to contain the energy cost and carbon footprint, the company has a strategic plan to install 10MWs of solar power plant, with 6 MW already been installed. Going forward, the management aims to optimize capacity utilization to enhance gross margins. BOPET production will support local sales, while BOPP will focus on driving export sales.

IPAK is the only Group in the country which offers all three variants of the most commonly used packaging films. The Company is actively expanding its exports, targeting new markets and customers. To drive export growth, it has established a subsidiary, IPAK Connect, in the UAE. Increased volumes are expected to enhance operating efficiencies and create synergies, positively impacting profitability.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.