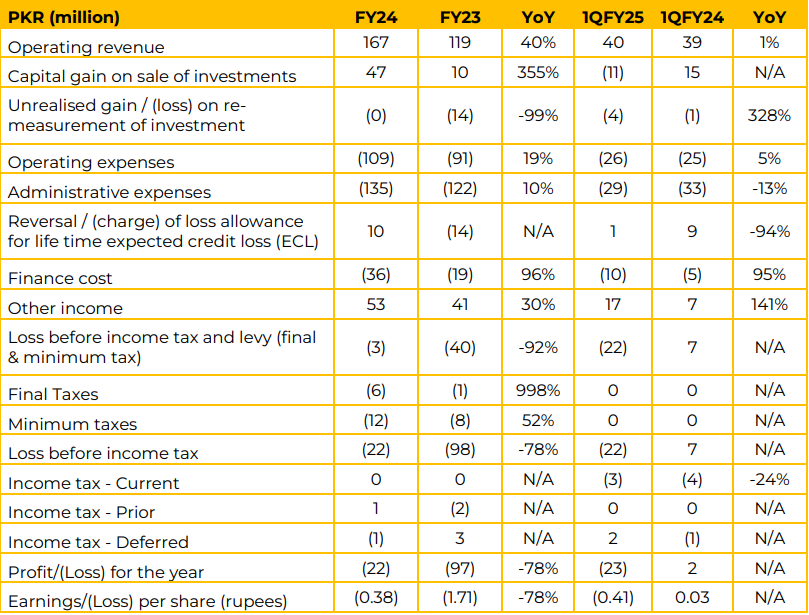

Operating revenue rose by 40% YoY in FY24, reaching PKR 167 million compared to PKR 119 million in FY23. In 1QFY25, revenue growth was remained stagnant at 1%, totaling PKR 40 million compared to PKR 39 million in 1QFY24.

Capital gains surged by 355% YoY in FY24 to PKR 47 million from PKR 10 million in FY23. In 1QFY25, however, the company incurred a loss of PKR 11 million, contrasting with a gain of PKR 15 million in 1QFY24.

Operating expenses increased by 19% YoY in FY24 to PKR 109 million, compared to PKR 91 million in FY23, driven by higher activity levels. In 1QFY25, these expenses grew by 5% YoY to PKR 26 million from PKR 25 million in the prior year.

Administrative expenses rose by 10% YoY in FY24 to PKR 135 million from PKR 122 million, attributed to inflationary pressures. Encouragingly, these expenses decreased by 13% YoY in 1QFY25 to PKR 29 million from PKR 33 million.

EPS improved YoY for FY24 to PKR -0.38 from PKR -1.71 but declined to PKR -0.41 in 1QFY25 compared to PKR 0.03 in 1QFY24. The management attributed higher expenses to increased spending over the development of new app “Finqalab” with 30.5 million spent so far. Since June 2024, 1000 accounts have been opened on this app. The management plans to spinoff this segment as a separate entity by March 2025.

In addition to stocks trading, this app would include mutual funds, insurance, commodities trading, digital wallet and digital lending features. Mutual funds are expected to be enabled by Jan-Feb of 2025, while other features might take 1-2 years. Initially there will be no subscription charges to acquire more users.

Going forward, the management does not seem interested in listing of IPOs due to ethical reasons. However, the company will continue other investment banking operations. With regards to higher expenses and net losses, the management noted that the results are likely to improve after six months.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.