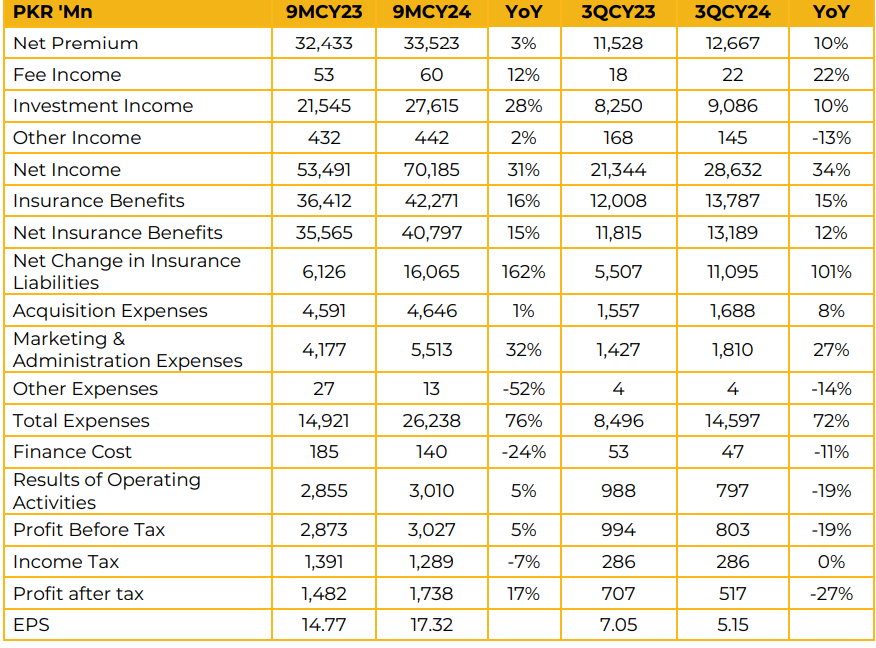

Jubilee Life Insurance Company Limited (JLICL) reported a net profit of PKR 1.74 billion (EPS: PKR 17.32) in 9MCY24. This represents a 17% increase compared to PKR 1.48 billion (EPS: PKR 14.77) in the SPLY. Net premium income for 9MCY24 increased by 3% year-onyear to PKR 33.52 billion, compared to PKR 32.43 billion in 9MCY23.

The premium segment composition includes 38% from individual life unit-linked, 20% from individual family Takaful, 26% from accident and health business, 10% from conventional business, and 6% from others. JLICL operates 151 branches across Pakistan and serves over 4,000 corporate clients.

It has the largest panel network of more than 600 hospitals in the country. The company launched conventional traditional products, including the Super Endowment Plan and Jubilee Noor Plan. JLICL is the largest player in the bancassurance segment, with the highest number of bank partnerships. Habib Bank Limited contributes 40% of its total bancassurance business.

The company shifted its focus towards corporate business from retail business, which has been impacted by higher inflation and reduced consumer purchasing power.

Despite these challenges, both retail and corporate segments recorded growth in 3QCY24, with a 10% increase in gross written premiums. The company enhanced its retail sales through bancassurance and its direct sales force. Investment income posted double-digit growth in 9MCY24, driven by mutual funds and government securities.

The company benefited from revaluation gains due to declining interest rates. A significant portion of its investment portfolio remains in unit-linked products. JLICL is exploring the launch of a Voluntary Pension Scheme (VPS) fund, either as a standalone fund or through existing offerings, in response to the government’s focus on VPS schemes. Management reported a 50% split between conventional and Takaful business, indicating the company’s readiness to transition to a zero-interest model. With Pakistan moving towards a Riba-free economy, JLICL anticipates growth opportunities in Ijarah Sukuk and similar Shariah-compliant instruments.

Looking ahead, the company plans to expand its digital business to enhance performance in 4QCY24. It aims to sustain its payout ratio, contingent on improved income levels.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.