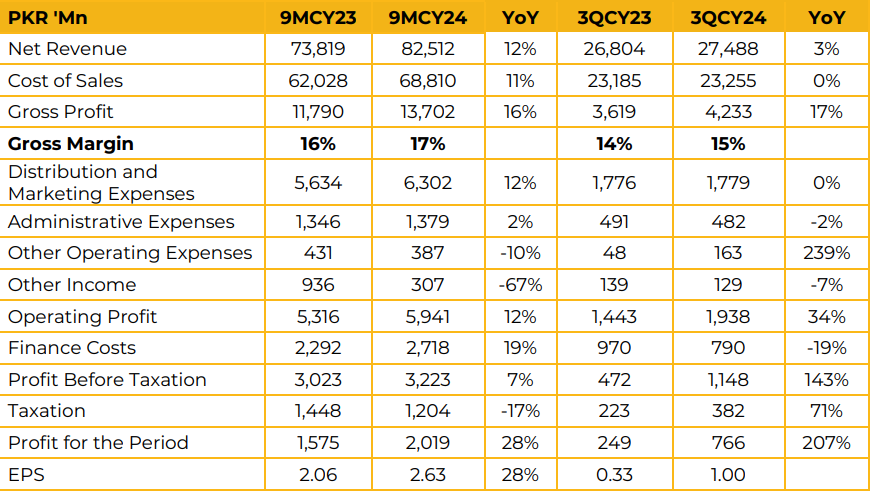

FrieslandCampina Engro Pakistan Limited (FCEPL) reported a net profit of PKR 2.02 billion (EPS: PKR 2.63) in 9MCY24, reflecting a 28% year-on-year increase from PKR 1.56 billion (EPS: PKR 2.06) in 9MCY23.

Revenue for 9MCY24 grew by 12% year-on-year to PKR 82.51 billion, compared to PKR 73.82 billion in 9MCY23. Farmsourced milk contributes 10-12% to total milk collection Management reported that packaged milk accounts for 8% of total milk demand, while loose milk constitutes 92%.

The potential for packaged milk is estimated at PKR 24 billion annually. FCEPL holds the highest market share in the UHT premium category. The company has installed a 3.4MW solar project at Sahiwal, expected to generate 5,013.6 MWh annually, and plans to expand this capacity. FCEPL operates a network of milk collection centers.

Credit sales for larger customers span 15- 20 days, while the average credit period is 2-3 days. In FY23, FCEPL achieved net revenue of PKR 100 billion, gross profit of PKR 14.4 billion, and operating profit of PKR 6.1 billion. The imposition of an 18% sales tax on packaged milk has impacted consumer purchasing power and company’s financial performance. FCEPL reduced loans by lowering inventory levels, releasing working capital in the process. Finance costs decreased by PKR 200 million in 3QCY24 due to lower interest rates, with the full impact expected in the fourth quarter of this year. FCEPL has doubled its exports since the previous year and plans to increase export volumes further. The company exports cream milk, powdered milk, ghee, and UHT milk to Muslim countries and has recently started exports to the USA. Pure cream milk has not achieved significant volumes after five years of launch, with low consumer uptake. Going forward, the company aims to reduce costs through operational efficiencies, vendor renegotiations, and minimizing discretionary spending

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.