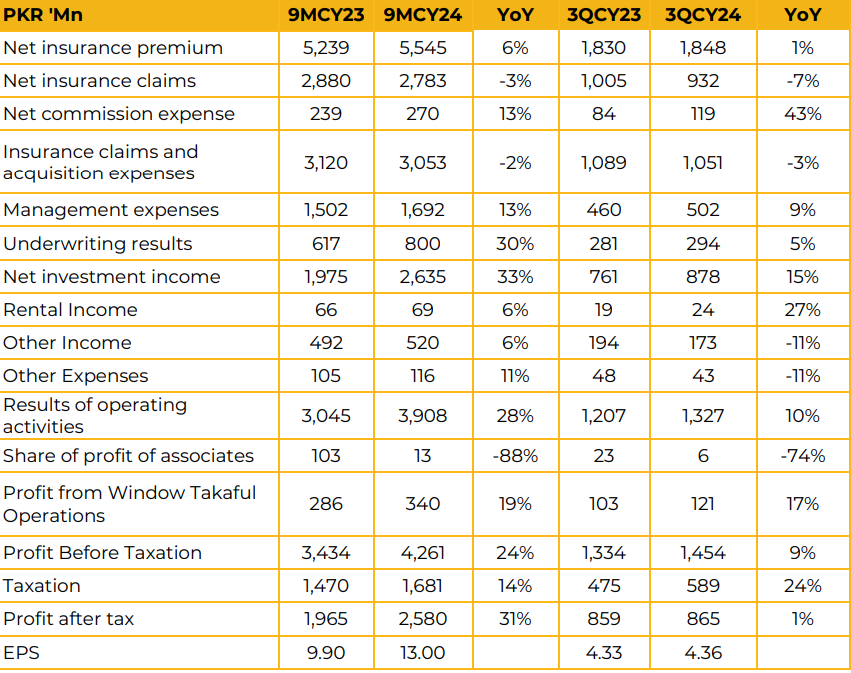

Jubilee General Insurance Limited (JGICL) reported a net profit of PKR 2.58 billion (EPS: PKR 13.00) in 9MCY24, a significant increase from PKR 1.96 billion (EPS: PKR 9.90) in 9MCY23. Net insurance premium for 9MCY24 rose by 6% year-on-year to PKR 5.54 billion compared to PKR 5.24 billion in the corresponding period last year. The portfolio mix was comprised of fire at 43%, miscellaneous at 19%, accident and health at 14%, motor at 12%, marine at 8%, and liability at 4%. Management reported that all business lines contributed to topline growth, alongside an expansion in the client base.

However, motor and health business segments faced a decline, attributed to the negative impact of Pakistan’s struggling auto industry. The miscellaneous category showed significant growth due to the introduction of valueadded products. JGICL holds a market share of 10.65% and ranks third in terms of gross written premium, following EFU and Adamjee. Its top 50% of customers contribute 35-38% to the topline, indicating no risk of concentration.

Management noted that investment income is expected to decline due to lower yields but anticipates this will be offset by higher returns on equities, which constitute 35% of its investment portfolio. Despite this, the company has no plans to increase its equity exposure due to liquidity considerations. JGICL is also collaborating with the SECP to advance thirdparty insurance.

Going forward, management aims to maintain the current payout ratio and expects the auto industry to recover in the next quarter, potentially revitalizing the motor segment. While cautiously optimistic about future growth given macroeconomic conditions, the company projects an 18- 20% growth by the end of the financial year.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.