Key Takeaways:

• Declining interest rates to reap positive benefits in subsequent quarters.

• APTMA demands Regional Competitive Energy Tariff from the government to revive Pakistan’s Textile Industry for the export market.

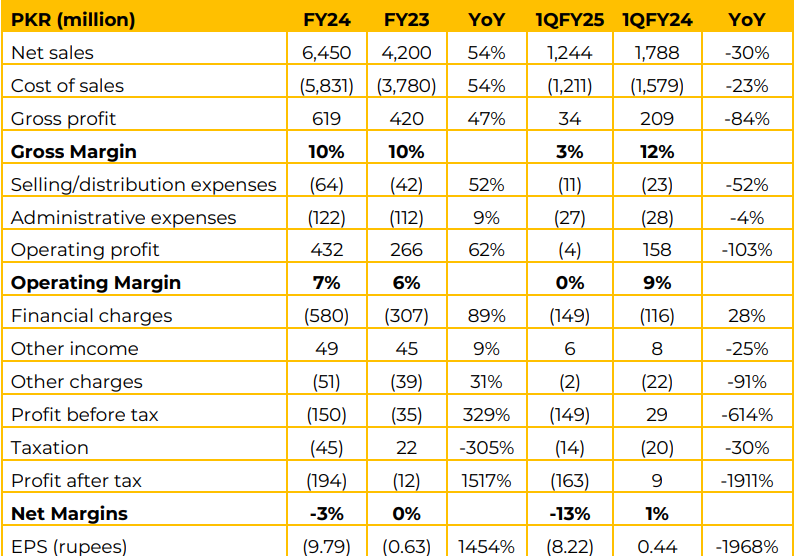

In FY24, net sales grew significantly by 54% YoY, reaching PKR 6,450 million compared to PKR 4,200 million in FY23. However, 1QFY25 witnessed a sharp 30% decline YoY in net sales to PKR 1,244 million. .

Cost of sales mirrored the revenue growth in FY24, increasing by 54% YoY. As a result, gross profit improved by 47% YoY to PKR 619 million.

However, gross margin remained flat at 10%. In 1QFY25, gross profit plummeted by 84% YoY to PKR 34 million, accompanied by a drop in gross margin to a mere 3%, primarily due to low demand in sales and high cost of imported cotton. Financial charges saw a significant 89% YoY jump in FY24 to PKR 580 million, likely driven by increased borrowing costs, adversely impacting profitability.

The company reported a loss after tax of PKR 194 million in FY24, a drastic decline from a marginal loss of PKR 12 million in FY23. This translates to a net margin of -3% versus 0% last year.

The trend worsened in 1QFY25, with a net loss of PKR 163 million compared to a profit of PKR 9 million in 1QFY24. Earnings per share (EPS) reflected this deterioration, falling sharply to PKR (9.79) in FY24 and PKR (8.22) in 1QFY25. The textile industry is demanding restoration of Regionally Competitive Energy tariff (RCET) in order to regain competitiveness in the international market.

Moreover, immediate attention of the government is required for improvement in local cotton crop both in terms of quality and quantity. Going forward, the management expects the decline in policy rate to reap positive benefits for the company starting from 2QFY25. Management also anticipates a positive bottom-line in the upcoming quarters contingent upon the lowering of finance cost and decline in energy cost.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.