Key Takeaways:

• Profitability Falls in FY24 Despite 60% Growth in Sales, Facing Global and Local Problems

• Sales Tax Adjustments Expected by April 2025

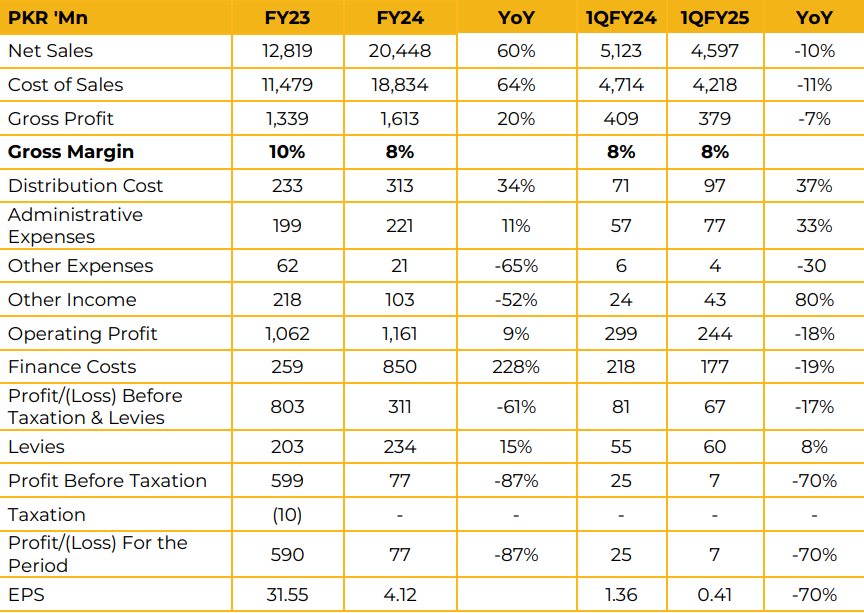

In FY24, the company reported a sharp decline in profitability, with net earnings decreasing to PKR 77.02 million (EPS: PKR 4.12) from PKR 589.95 million (EPS: PKR 31.55) in FY23. Sales of NAGC rose to PKR 20.45 billion during the year, compared to PKR 12.82 billion in the corresponding period last year.

Gross profit increased to PKR 1.61 billion, up from PKR 1.34 billion in FY23, supported by higher revenue. Management outlined several challenges impacting performance, including compressed margins, subdued demand, inconsistent energy supply, taxation policy uncertainties, and heightened global competition driven by elevated energy costs.

The global economic slowdown, particularly in China, added further pressure on export markets. The company expects the funds tied up in sales tax to be adjusted against output tax by March-April 2025. The exportto-import ratio of cotton stood at 80:20 during the year.

Additionally, management noted that solarization initiatives and a stable gas supply contributed to cost efficiencies. Under the Export Financing Scheme (EFS), imported yarn is exempt from sales tax, provided the resulting thread and cloth are exported. Looking ahead, management is optimistic about a recovery in the Chinese economy, anticipating improved export demand and margin recovery in the coming fiscal periods.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.