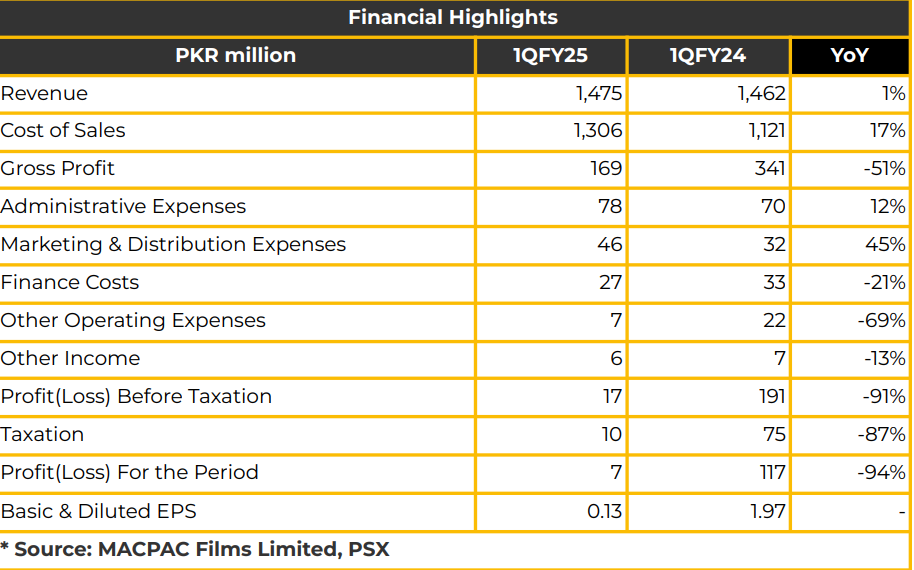

In 1QFY25, MACPAC Films Limited reported a net profit of PKR 7.45 million (EPS: PKR 0.13), a significant 94% decline from PKR 116.70 million (EPS: PKR 1.97) in the same period last year. The reduction in profitability was largely due to higher gas prices and higher inflation. Net sales rose by 1% to PKR 1.48 billion in 1QFY25, with exports growing to PKR 8.61 million. MACPAC is currently exporting to North America, Europe, and the Middle East.

However, topline growth was impacted by supply constraints. Gross profit fell 51% YoY, from PKR 341.35 million to PKR 168.90 million. In 1QFY25, gross profit margins declined to 11.5% (SPLY: 11.9%), operating profit margins fell to 1.2% (SPLY: 1.4%), and net profit margins were at 0.5% (SPLY: 1.0%).

Increased competition and expanded supplies from industry players further pressured prices and revenue. Management indicated stable production and sales volumes at approximately 18,126MT (BOPP: 12,103MT, CPP: 6,023MT) for production and 16,851MT (BOPP: 11,351MT, CPP: 5,500MT) for sales in FY24. Production volumes were low due to rising gas prices and plant maintenance activities.

The volume decline was also attributed to a shift toward value-added products. In FY24, revenue remained stagnant at PKR 5.6 billion. Profitability decreased to PKR 257 million (EPS: PKR 4.35) from PKR 379 million (EPS: PKR 6.39) in the prior year, mainly due to increased costs that could not be fully passed on. Tax contribution was reported at PKR 1.23 billion, with net equity at PKR 2.2 billion.

Gross margins dropped to 16.5% (SPLY: 23.8%), while operating margins were at 4.6% (SPLY: 6.9%).Domestic gas rates in 2024 rose to PKR 3,000/mmbtu, FY24. Increased gas prices had a PKR 251 million impact on profitability. Management’s key focus remained on cost reduction and efficiency improvements rather than revenue growth, considering weak demand and limited pricing power due to deteriorated consumer purchasing power and rising utility costs. MACPAC’s subsidiary in Dubai aims to boost exports, with future potential for different transaction types subject to SBP approval.

The company’s energy mix includes gas and RLNG, with 1MW dedicated to cost reduction. Going forward, management expects demand to improve due to an improved macroeconomic outlook. Due to rising gas prices and potential gas curtailments for captive power plants, MACPAC is exploring alternative energy options. Management is focused on bottom-line growth through cost efficiencies and product diversification in the value-added segment.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.