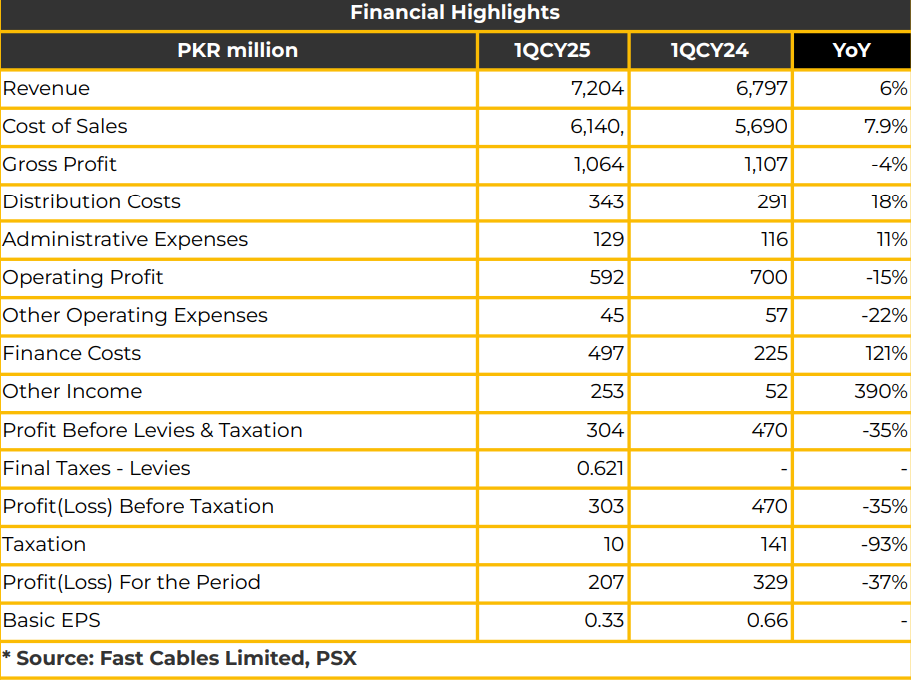

In 1QCY24, Fast Cables Limited (FCL) reported a net loss of PKR 206.76 million (EPS: PKR 0.33), compared to a net profit of PKR 329.02 million (EPS: PKR 0.66) in the corresponding period last year.

Net revenue increased 6% YoY, reaching PKR 7.20 billion in 1QCY24, up from PKR 6.80 billion. Of this growth, 25% was attributed to volumetric growth and 75% to price increases. Gross profit declined 4% YoY to PKR 1.06 billion in 1QCY24 from PKR 1.11 billion last year.

Capacity utilization was reported at 70-75% in FY24, with FCL operating 5-10% below maximum capacity. Management anticipates an increase in capacity by 2026 following expansion. Funds for other income have been allocated to working capital requirements. Finance costs were offset by other income in the same period.

Management indicated ongoing collaboration with the government on anti-dumping duty enforcement. Loans to associated companies amount to PKR 1.5 billion, expected to decline by year-end. FCL expects income from an associate company engaged in transmission business upon project completion within 1-2 months.

Cables constitute 90-95% of FCL’s business. The company faced pressures from finance costs and taxation in FY24, along with price pressure from copper and high competition affecting gross profit in 1QFY25.

Market segments include housing, trade, B2B sales to commercial/industrial entities, and institutions like NTDC, K-Electric, and DISCOs, with exports to the Middle East and Africa. Management foresees significant demand after the privatization of distribution companies and is negotiating with Saudi companies for exports.

The electric cables and wires industry is valued at PKR 200 billion, with formal players covering 50%, cottage industry 40%, and importers 8-10%. The formal players are capturing market share with import substitution.

Management expects the industry to double within five years, with an 8-year CAGR of 18%. LME prices remained stable at approximately $9,000/ton for copper and $2,000/ton in FY24. Management plans to increase production capacity and adopt advanced technologies with IPO funds.

Over the past five years, revenue grew at a 38% CAGR, reaching PKR 26 billion in FY24. Profit increased from PKR 167 million in FY20 to PKR 1.9 billion in FY24. Gross margins rose to 19% from 18% in the prior year. Operating and net profit margins remained stable at 13% and 5% in FY24, respectively.

The company’s primary client is K-Electric, which invests in network upgrades, while other DISCOs do not invest in transmission lines. For EV infrastructure, management plans to cater to household demand for EV charging cables and anticipates additional demand following the development of EV infrastructure in road networks.

Going forward, FCL expects sustained growth due to rising demand for cables and conductors across sectors, along with operational efficiencies. Management anticipates improved revenue and profitability in the upcoming quarters.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.