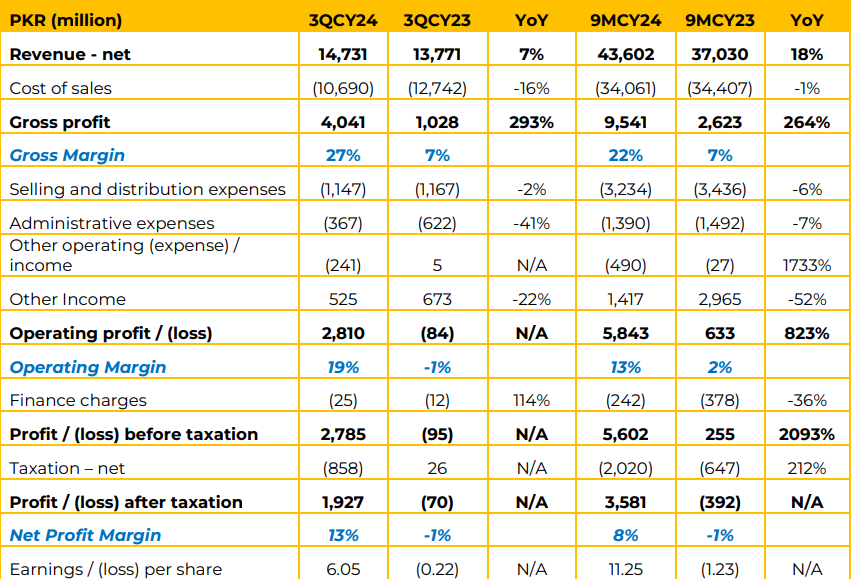

For 3QCY24, GLAXO reported a 7% increase in net revenue, reaching PKR 14.73 billion compared to PKR 13.77 billion in 3QCY23. On a nine-month basis, revenue grew by 18% YoY, totaling PKR 43.60 billion for 9MCY24 compared to PKR 37.03 billion in 9MCY23.

Cost of sales decreased by 16% in 3QCY24, amounting to PKR 10.7 billion, compared to PKR 12.7 billion in 3QCY23. For 9MCY24, cost of sales saw a marginal decrease of 1%, totaling PKR 34.1 billion, compared to PKR 34.4 billion in 9MCY23. Gross profit increased significantly by 293% in 3QCY24, reaching PKR 4.04 billion, compared to PKR 1.03 billion in the same period last year. Gross margin also improved, rising to 27% in 3QCY24 from 7% in 3QCY23.

Gross profit for 9MCY24 was PKR 9.54 billion, up 264%, with a gross margin of 22%, compared to 7% in 9MCY23. The higher gross margin this year is due to price increase as result of deregulation of non-essential products and approval of hardship cases.

Operating profit in 3QCY24 was PKR 2.81 billion, compared to an operating loss of PKR 84 million in 3QCY23. Year-to-date, operating profit was PKR 5.84 billion, up from PKR 633 million in 9MCY23. Operating margin improved to 19% in 3QCY24, compared to -1% in 3QCY23, and to 13% for 9MCY24, compared to 2% in 9MCY23.

Despite multiple queries, the management wasn’t comfortable in mentioning the portfolio mix of essential and non-essential products.

However, they stated that it is similar to the other players. Upon a question regarding MNCs leaving Pakistan, the management highlighted that there is no such intention, rather the company is strengthening its foot print in Pakistan.

They also mentioned that the GLAXO is also engaged in toll manufacturing for other players as well. Going forward, the management expects the financial performance to improve further as the regulation eases. To benefit from the de-regulation of non-essential goods the company is maintaining its product portfolio accordingly.

Regarding dividends, the GLAXO management indicated a decision would be made after the current financial year concludes.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.