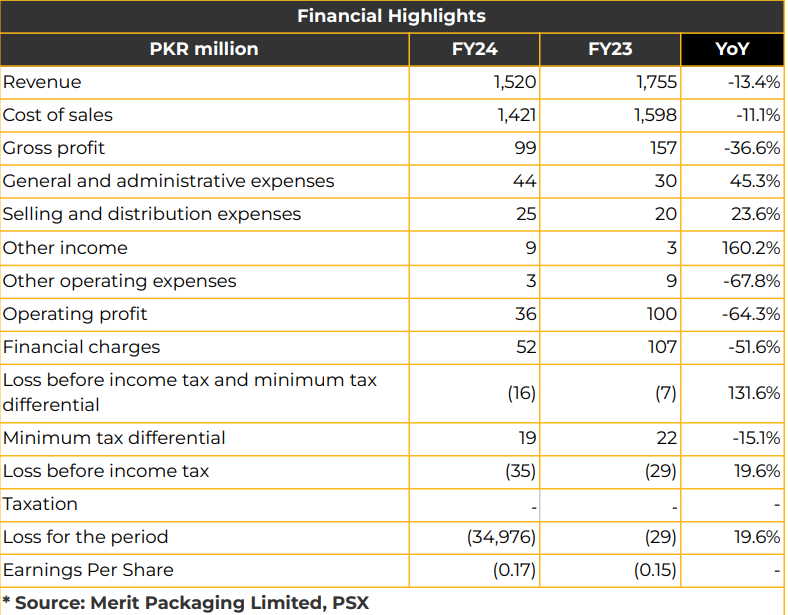

In 1QFY25, Merit Packaging Limited reported a net loss of PKR 34.98 million (LPS: PKR 0.17), a significant increase from the PKR 29.25 million loss (LPS: PKR 0.15) in the same period last year.

Revenue declined by 13% YoY to PKR 1.52 billion, down from PKR 1.75 billion in 1QFY24, while gross margins fell to 6.5% from 8.9% due to higher production costs. Management attributed the sales decline to lower volumes and price pressures from market overcapacity.

The cost of sales decreased by 11% YoY to PKR 1.42 billion, from PKR 1.60 billion in the prior year. Gross profit and operating profit dropped by 37% and 64% YoY, respectively, reaching PKR 99.20 million and PKR 100.36 million in 1QFY25. Administrative expenses rose by 23% YoY to PKR 30.48 million, while selling and distribution expenses fell by 17% YoY to PKR 35.88 million.

Financial charges declined by 46% YoY to PKR 51.89 million in 1QCY25. The offset division has a production capacity of 1300 MT per month. In the Gravure division, top-notch machinery is capable of printing nine colors with three laminators, two slitters, and two rewinders.

Merit Packaging employs FSC-certified board and water-based ink to reduce carbon footprints. Since 2021, the company has reduced its losses from PKR 565 million to PKR 183 million in FY24. Operating cash flow improved from a negative PKR 143 million to PKR 417 million over the same period.

Management reported revamping two production facilities from internal funds and becoming a key supplier to top companies, along with achieving export orders to Kenya and the UK, with further export orders booked for FY25. Despite a sluggish economy, management raised revenue by 4.7% YoY and reduced net losses by 2%. The company has benefited from strong sponsor support, including a PKR 1.4 billion capital injection in FY22, periodic rescheduling of interest-free loans, and an additional PKR 250 million loan in FY21.

A sale-and-leaseback arrangement was implemented to reduce finance costs. Management reported that waste materials are recycled to produce plastic toys and utilities. They plan to declare dividends once losses are covered, with a target revenue of PKR 1.6-1.7 billion and an improved economic outlook. Imported paperboard from China remains a cost-effective input.

Looking ahead, management anticipates further margin compression. Management plans to delay imports of cutting and dyeing machinery until global and domestic conditions improve. Management reported that future expansion is on hold until prices and volumes recover.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.