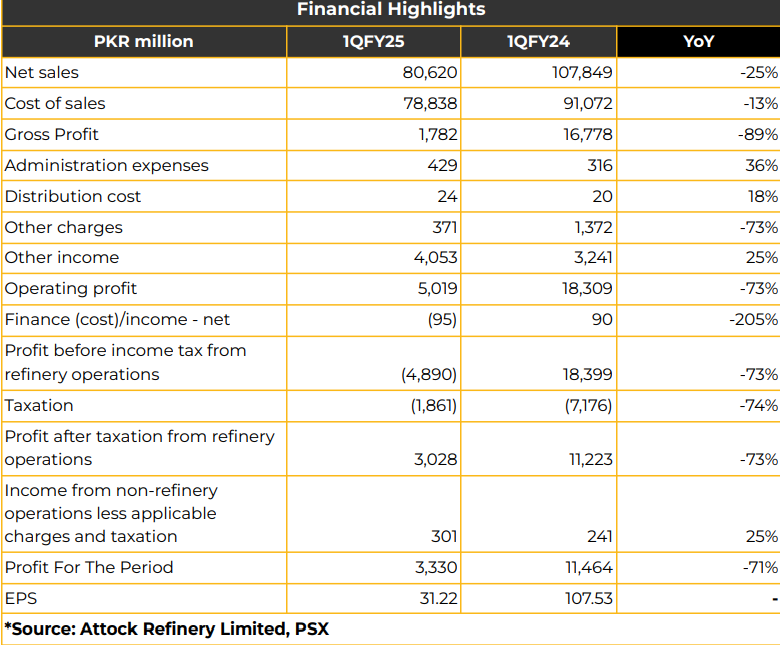

In 1QFY24, Attock Refinery Limited (ATRL) reported net profits of PKR 3.33 billion (EPS: PKR 31.22), a 71% YoY decline from PKR 11.46 billion (EPS: PKR 107.53) in the same period last year.

The profitability was mainly driven by improved spreads between product prices and crude oil. During the period, ATRL earned PKR 3.03 billion from refinery operations and PKR 301 million from non-refinery operations. In FY24, ATRL’s product sales breakdown was 35% HSD, 34% PMG, 2% export naphtha, 8% jet fuel, 17% furnace oil, and 5% other fuels. GRMs dropped to $14/barrel due to geopolitical factors, compared to $12/barrel last year. In 1QFY25, GRMs further declined to $9/barrel.

Refinery throughput in FY24 slightly increased to 1.80 million tons, with net sales of PKR 382.92 billion, boosted by PKR depreciation. Gross sales rose to PKR 505.29 billion, yielding net profits of PKR 25.24 billion. ATRL’s market share stands at 10%, competing with imports (37%), PARCO (27%), NRL (8%), PRL (8%), Cynergico (6%), and others (4%). ATRL completed an integrated turnaround in 33 days after five years.

It exported 80,000 tons of low-sulfur fuel oil (LSFO) at a premium, compensating for reduced FO demand over the past five years. Management achieved a premium of $56-70 per ton on exports, offsetting higher transportation costs from north to south. Management noted delays in the refinery policy’s implementation due to sales tax issues. ATRL loses PKR 1 billion annually from these delays. Currently, ATRL exports 120,000 tons quarterly after meeting 20-25% of local furnace oil demand.

An incentive of 2.5% on HSD and 10% on motor gasoline is proposed to encourage refinery upgrades. These deemed duties would go into an escrow account, covering 27.5% of upgrade costs, with a 70:30 debt-to-equity ratio for project financing.

Management flagged issues of excess imports and smuggling affecting HSD uplift. ATRL is working with OGRA and relevant ministries to control this, showing partial success.

The Economic Coordination Committee (ECC) has approved a 5,000-barrel crude allocation from the south due to declining supplies from the north (40-42,000 barrels). Pending freight issues are causing delays in the execution of this project. ATRL aims for 100% capacity utilization with increased crude supply and expects higher motor gasoline output pre-upgrade.

After the upgrade, ATRL will produce 95 RON gasoline, compared to the current 91 RON, addressing penalties for the difference from imported 92 RON Euro II gasoline. ATRL currently produces Euro III HSD with 350 ppm sulfur, while Euro V requires 10 ppm. The upgrade will align with Euro V, saving PKR 15 billion annually by eliminating penalties and additive costs. FY24 production volume was 580,000 MT HSD, 364,000 MT FO, 579,000 MT PMG, 148,000 MT jet fuel, and 40,000 MT naphtha.

Furnace oil comprised 15-20% of total output; management expects FO levels to remain stable post-upgrade to meet local demand. Looking ahead, ATRL plans upgrades to produce Euro V motor gasoline and HSD under the refining policy, projecting to save PKR 12 billion and increase Euro V motor gasoline output by 25%.

Domestic production currently meets 30% of motor gasoline demand, with 70% imported, and the project is expected to enhance profitability due to high product margins amid declining financing costs. ATRL also aims to introduce continuous regeneration catalysts, boosting PMG output by 25%, and revamping its DHDS unit to produce Euro V diesel. The company anticipates potential challenges in crude oil availability but expects benefits from new explorations.

Disclaimer:

This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.